When one door closes, another may open

Unsplash

Unsplash Unsplash

Unsplash· 20 min read

As tensions escalate in the Strait of Hormuz—with Iranian posturing, Israeli-Iranian maritime escalation, and U.S. fleet repositioning—the global oil market faces renewed scrutiny of its chokepoint dependencies. Over 20% of the world’s crude passes through Hormuz, making it the single most critical corridor for Middle Eastern oil exports. With Iran attacking US bases in Qatar, and oil prices slipping in response, the volatility raises questions about the geopolitical swings that can quickly impact the availability and economics of Middle Eastern crude movements.

At the same time, a new light sweet crude from offshore Guyana—Golden Arrowhead, produced predominantly by ExxonMobil’s Stabroek block—has rapidly gained market attention. With the first 1-million-barrel lift scheduled for August 31 - September 1 this summer, output is expected to ramp up toward 1.2 million bpd by 2027. Guyana’s new barrels are increasingly positioned as marginal supply for the Atlantic Basin, with a much lower reliance on maritime chokeholds to reach key refinery markets.

• Whether Golden Arrowhead can backfill supply shortfalls caused by a Hormuz disruption

• Freight market reconfigurations triggered by rerouted flows

• Refinery system mismatches in Asia vs. West

• The strategic role of ExxonMobil’s offshore FSOs in global flexibility

The conclusion is as follows: While Guyana offers marginal barrels, substitution is non-trivial. Mismatched refinery specifications, VLCC logistics, and political frictions ensure that the world may be left with more oil—but not the right oil in the right place.

At just 21 nautical miles wide, the Strait of Hormuz has long represented a geopolitical fault line disguised as a shipping lane. Iran’s threats to close the strait have historically catalyzed spikes in VLCC rates, reallocation of fleet positions, and temporary hoarding behavior among Asian refiners.

On Monday 23rd June, Iran launched missiles at a US air base in Qatar, causing brent to drop 7.2%, representing the steepest daily fall in circa. 3 years. This fall took place despite rising tensions as the Al Udeid air base in Qatar was actually emptied days prior to the missile attack, rendering the missile attack ineffective in adding geopolitical risk premium and prompting a ceasefire. Traders expect the downward trend to continue, however speculations on risk and chokehold vulnerability still remain in the air. Access to Gulf oil is key to the Chinese and European refinery markets particularly, with 13% of China’s total oil imports coming from Iran in 2023.

• ~21 Mbpd in crude and condensate pass daily through Hormuz

• 80% of Saudi, Emirati, Qatari and Kuwaiti exports rely on it

• Primary destinations: India, China, Japan, South Korea

The potential disruption of Hormuz is not hypothetical—it’s structural. The market’s fragility lies not in the absence of oil, but in the inability to reroute it efficiently and quickly in the face of chokehold or broader geopolitical disruptions.

Golden Arrowhead is a branded light sweet crude emerging from the ExxonMobil-operated Stabroek block. Its key characteristics:

• API Gravity: ~36.5 (American Petroleum Institute)

• Sulphur Content: ~0.25-0.5%

• Stability: High, low metal content

• Processing Suitability: Ideal for mid-complexity USGC refineries and blend-friendly terminals

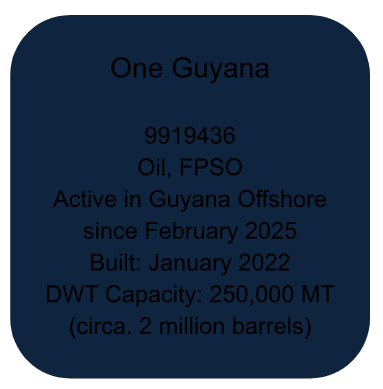

Production will be supported by Floating Production, Storage and Offloading Unit (FPSO) MV Guyana One, with consortium partners exporting their share (Exxon, CNOOC, Hess):

Source: SBM Offshore

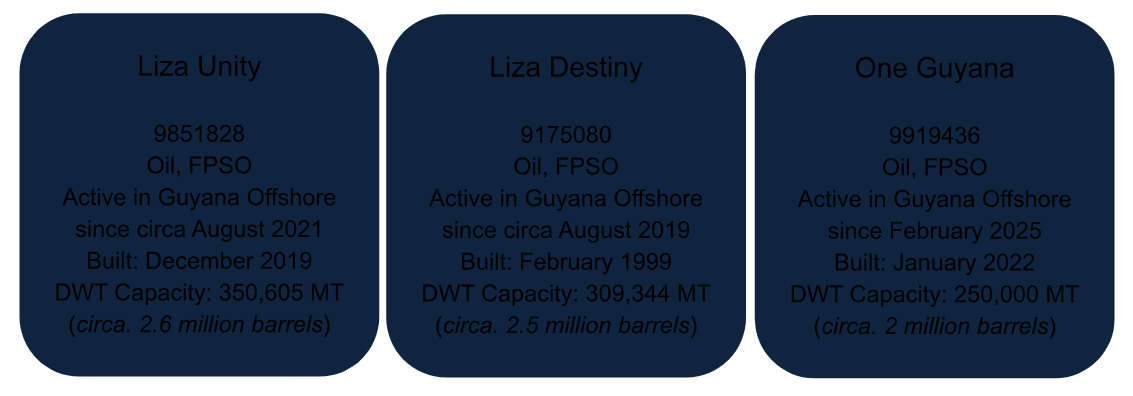

Other FSO units active in the Guyana Offshore, operated officially by ExxonMobil include:

Together, these FPSOs represent over 1 million DWT of floating infrastructure within the Guyana oilfields, with onboard storage of ~2 million barrels per unit. They allow direct loading of Aframax and Suezmax vessels without shore-based terminals, enabling dynamic exports to both North America and Europe. ExxonMobil’s modular infrastructure ensures a flexible response to shifts in arbitrage economics.

With up to 6 FPSOs expected by decade-end, Guyana could emerge as the most scalable Atlantic Basin light sweet producer outside U.S. shale.

Ship-to-Ship Transfer and Operations history for the above FPSOs is mostly domestic, with recorded operations with nearby Platform Supply Ship and Platforms. One Guyana’s STS history for the whole of 2025 to date is with Platform Supply Ships overwhelmingly, with 2 bunkering operations in February with a Products tanker and a Bunkering Tanker.

An almost identical trend can be seen for the 2025 recorded STS activity of the MV Prosperity, with most being short STS operations with Platform Supply Ships with the same Guyana offshore zone. Nevertheless, a round of two STS events with MV Decathlon (Tsakos Shipping & Trading), a Suezmax Crude Oil Tanker, may shine some early light on Golden Arrowhead’s future freight flows. MV Decathlon was active in Guyana Offshore during month of March until now (June 2025) and is currently (as of June 2025) sailing laden towards Northwest Europe, with indicated destination STS Southwold, a recognised permit area for oil cargo transfers up to 320,000 DWT in the UK. This indicates two product runs from Guyana to the NW Europe/ARA segment. This matches the general analysis of the Golden Arrowhead specs matching non-complex refinery profiles within the European and USG segments.

Even more interestingly for this analysis, the MV Decathlon, following loading and discharging of Guyana crude in NW Europe then sailed to Tubarao anchorage (Brazil) before going back to Guyana, suggesting easy freight trading optionality between the two grades for tankers active in the South American segment, showing early signs of potential blending or co-loading.

| Crude Grade | API Gravity | Sulphur (%) | Pour Point | Typical destinations |

| Golden Arrowhead | ~36.5 (American Petroleum Institute) | ~0.25- 0.5% | Low | U.S., Europe, China (opportunistic) |

| Iranian Light | ~33.6 | ~1.5% | Higher | China, India, Turkey, South Korea (pre-sanctions) |

Implications:

• Iranian Light is significantly more sour and is tailored to high-complexity Asian refineries with desulphurisation capability.

• Golden Arrowhead has a lighter distillation profile, generating more naphtha and distillates, and less residuals—a poor match for complex refiners expecting higher middle distillate cut.

• Yield mismatch can distort refinery economics unless blended.

Overall, while both crudes fall under "light" grades, Golden Arrowhead cannot function as a direct plug-in for Iranian Light in core Asian markets. Substitution may ease political exposure, but introduces yield and processing inefficiencies. The story is different in the West, where USGC and European refiners are structurally compatible.

|

Importing Region |

Hormuz Exposure |

Arrowhead Suitability |

Key Issues |

|

India |

High |

Poor |

Designed for medium/heavy sour; efficiency and yield loss expected |

|

China |

Moderate |

Partial |

Some flexibility via teapot refiners; freight inefficiencies for VLCCs |

|

USGC |

Low |

Excellent |

Refineries designed for light sweet; minimal adaptation needed |

|

Europe (ARA) |

Moderate |

Good |

Blendable; Suezmax-friendly routing |

|

Africa (WAF/North) |

Low |

Fair |

Some substitution possible via co-loading strategies |

Key Constraint: Guyana exports via Aframax/Suezmax, not VLCCs—limiting cost-efficient long-haul flows to Asia, especially under tight tonnage conditions.

While Golden Arrowhead’s yield and sulphur profile differ materially from Iranian Light and Basrah Light, blending offers a middle path—a way to adapt light-sweet cargoes to heavier refinery diets while also enabling VLCC-scale aggregation for long-haul delivery.

|

Crude Grade (name) |

API |

Refinery Suitability |

|

Golden Arrowhead |

~36.5 |

U.S. Gulf Coast, Europe (light-complexity) |

|

Iranian Light |

~33.6 |

India, China, Turkey (high-complexity, sour-tuned) |

|

Basrah Light |

~30.5 |

Deep conversion Asian refiners (cokers, hydrocrackers) |

The sulphur delta is the key challenge to modify from a cargo blending perspective. Without blending, Arrowhead creates light distillate imbalance and reduces residue production, underutilizing refinery hardware tuned for heavier cuts.

1. Golden Arrowhead + Brazilian Tupi or Búzios (Medium-Sour Atlantic)

• Mix ratio: 60:40 (Arrowhead:Tupi)

• Objective: Slightly raise sulphur while retaining light distillate profile

• Benefit: All-Western Hemisphere play—feasible via co-loading at offshore STS hubs

• Adds VLCC viability if loaded ex-Guyana + Brazil

2. Golden Arrowhead + Russian ESPO / Urals (Sanction-sensitive)

• Mix ratio: Variable depending on availability

• Use case: For buyers in Asia/India willing to accept de-flagged or blended-origin cargoes

• Risk: Traceability, EU embargo circumvention scrutiny

3. Golden Arrowhead + Venezuelan Merey (For Chinese Teapot Refinery Market)

Given the importance of China to Iran’s crude exports, this is a key “replacement” segment to consider in potential contexts of Strait of Hormuz vulnerability. Golden Arrowhead on its own is too light and too clean, and likely cannot compete at the discounted levels of the high sulfur heavier crude used by the teapot market.

• Mix ratio: 60:40 (Arrowhead:Merey)

• Objective: Lower API gravity to 28-32, increase sulfur content, improve vacuum residual residue, and create a price-discounted barrel price.

• Benefit: Replacement value to China in geopolitically volatile Gulf situations

Target Spec in this scenario

60:40 Blend would give:

API: ~28.3

Sulfur: ~1.3%

High residual value and cheap sulfur processing.

Given the discounted Merey barrels, such blend could plausibly price below ESPO, Oman and even sanctioned Iranian light, however freight and voyage planning could be difficult if trading VLCC vessel is flagged as shadow fleet, or struggles to find bunkers due to the Venezuela tanker call.

One of the biggest operational barriers to Arrowhead’s substitution potential is its reliance on Suezmax and Aframax liftings from FPSOs.

Blending offers a structural on-ramp to VLCC economics to improve the per barrel cost, however this also requires significant modelling and scenario analysis given the sunk costs involved in the voyage planning and chartering of VLCCs, particularly in volatile markets like we see currently. Nevertheless, examples could include:

• Bahamas, Trinidad, Aruba, or even off Dakar could serve as floating STS zones for co-loading Brazilian, Guyanese, or U.S. Gulf blends.

• A 2:1 blend of Arrowhead and Tupi could yield a 1.9–2M bbl VLCC cargo with ~1% sulphur and ~31.5 API—very close to Iranian Light.

• Caribbean VLCC aggregation also aligns with ExxonMobil’s own freight strategy—many of their U.S. Gulf cargos already go through lightering or blending loops.

This transforms Guyana from a light-sweet outpost into a contributor to scalable, flexible, long-haul crude streams. However, one must consider the pricing of such blending, as in a geopolitically cooled environment, with elevated US-Continent TC rates, it may not compete with Basrah/Iranian light if the Strait of Hormuz remains generally unaffected.

Refiners in India, China (Shandong), and Indonesia have shown flexibility in recent years — accepting blended cargoes where single-origin feedstocks fell short due to sanctions or arbitrage gaps.

Why it matters:

• These refiners prioritize delivered value per barrel, not purity of origin

• A “Guyanese blend” that mimics Iranian Light’s yield curve—even if slightly off-spec—can close the commercial gap

Blending also enhances marketing of the specs as refinery runs offer more real data on the grade quality:

• A 1.5% sulphur, 32 API crude can be delivered FOB in VLCC lots

• Makes it tradable in physical windows like Platts Dated Brent alternatives or Far East spot auctions.

As such, blending is often a freight and product flexibility enabler, margin equalizer, and geopolitical softener where chokeholds are not involved in its physical execution, as is the case in offshore Guyana to USG, Europe or Asia. It creates a feasible VLCC-scale substitution potential via blending strategies within the South American cross-barrel segment, and introduces Arrowhead to buyers who may otherwise be structurally barred from direct adoption. Though Guyana may not be able to move up the crude complexity ladder without changing the barrel, it is certainly an interesting analysis to consider in times of deep market uncertainty around the Middle East and tanker deployment in the Strait of Hormuz and in northbound Suez traffic for PG to NW Europe trades.

If we look into the preliminary pricing modelling and estimates, we see an interesting picture emerge in terms of crude substitution economics. To estimate where a ~60:40 Arrowhead–Tupi blend might trade relative to WTI FOB and Iranian Light, we need to consider the blend’s specs, current price differentials, freight costs, and refinery yield value.

|

Property |

Golden Arrowhead |

Tupi |

60:40 Blend (Est.) |

|

API Gravity |

~36.5 |

~29.0 |

~33.5 |

|

Sulphur (%) |

~0.5 |

~0.9 |

~0.51 |

|

Yield |

Light sweet profile |

Medium sour, more vacuum residue |

Balanced with good distillate cut |

This is lighter and cleaner than Iranian Light (33.6° API, ~1.5% sulfur) and as such suitable for complex refineries that prioritize clean middle distillates and low-sulfur inputs. As such, it is more refinery-friendly for Atlantic Basin and West African converters, yet less optimal than Iranian Light for Asian heavy-complexity refiners - a higher Tupi blend proportion would likely be needed to act as a substitution product to the Far East market.

|

Crude |

Reference Price |

Notes |

|

WTI FOB USGC |

~$78.00/bbl |

Reference point for FOB light sweet |

|

Tupi FOB Brazil |

~$75.00–76.00/bbl |

Medium-sour, often discounts ~$2–3/bbl to Brent |

|

Iranian Light (pre-sanctions parity) |

~$80.00–83.00/bbl (hypothetical) |

Priced close to Brent equivalent, when flowing freely |

|

Platts Dated Brent |

~$82.00–83.00/bbl |

July 2025 forward curve context |

|

Metric |

Value |

|

WTI FOB USGC |

~$78.00/bbl |

|

Tupi FOB Brazil |

~$75.00–76.00/bbl |

|

Golden Arrowhead Implied FOB |

Likely ~$79.00–80.00/bbl (premium sweet) |

|

Blended 60:40 Arrowhead–Tupi |

Estimated FOB: $78.25–78.75/bbl |

With STS + blending logistics (~$1.00–1.20/bbl):

Delivered FOB Caribbean: ~$77.00–77.50/bbl

Into Asia (VLCC long-haul penalty + weaker yield match):

Landed into Asia: ~$74.50–75.50/bbl

|

Crude |

Sulfur (%) |

Estimated Price |

Comments |

|

60:40 Arrowhead–Tupi |

0.51 |

$77.00–77.50 (FOB) |

Clean, light, viable for USGC/ARA |

|

WTI FOB |

0.24 |

$78.00 |

Strong USGC benchmark |

|

Iranian Light |

1.5 |

~$80.00–83.00* |

High-sulfur, heavier residue yield |

|

Tupi |

0.9 |

~$75.00 |

Lower yield of lights |

*Iranian Light pricing is illustrative and assumes pre-sanctions parity.

Overall, ceteris paribus (all else remaining the same), 60:40 blend of Golden Arrowhead and Tupi yields a ~33.5° API, ~0.51% sulfur crude—lighter and significantly cleaner than Iranian Light. It would likely trade at $77.00–77.50/bbl FOB Caribbean, making it marginally cheaper than WTI and materially more attractive for Atlantic Basin refiners looking to hedge against Hormuz-linked disruption. While it may face resistance in Asia due to VLCC freight and distillate cut preferences, it offers a credible, scalable substitution path for USGC, ARA, and even West African refiners currently dependent on medium-light Iranian grades. Nevertheless, a side-by-side drop-in replacement of Iranian light would require a higher blend of medium sour to get the sulfur and API right for the Chinese refiners particularly, which would impact the economics quite significantly on a $/bbl basis.

In disruption scenarios, tankers become the first signal of structural stress. During the 2019 Fujairah attacks, TD3C (VLCC AG–China) rates tripled despite uninterrupted flows. Market psychology around chokepoint exposure manifests in instant day rate volatility and fleet repositioning.

Guyana, however, ships short-to-medium haul:

• Aframax/Suezmax scale

• As mentioned, little to no VLCC compatibility unless co-loading via Brazil or Caribbean transshipment

|

Route |

Hormuz Disruption Impact |

Substitution via Guyana? |

|

AG–China (TD3C) |

Rate spike, reduced AG liftings |

No direct substitution |

|

USG–EU (TD20) |

Moderate tightening |

Yes, Guyana may relieve pressure |

|

Guyana–India |

Long-haul, inefficient |

Limited feasibility |

|

Guyana–USGC |

Optimal |

Fully viable |

Thus, Guyana’s substitution potential is regionally bounded by tanker economics, not just geology.

ExxonMobil’s use of high-capacity FSOs (Liza Destiny, Unity, Prosperity) introduces floating elasticity into crude supply—a distinct advantage over fixed terminal systems in the Gulf.

The main relevant advantages within such operations is that it is partially decoupled from port risk, meaning there is less operational resilience if cargoes are delayed, redirected, or blended. The additional onboard storage positions of Exxon, in the region of >2Mbbl/unit offers prime strategic flexibility.

If AG exports are delayed or embargoed, Exxon’s FSOs can absorb arbitrage demand spikes quickly, especially to the USGC and Europe. East-of-Suez routing would require structural changes (e.g., Caribbean VLCC loading), but becomes increasingly viable as co-loading infrastructure matures in the Western Hemisphere.

In effect, Guyana becomes not just a new source of oil—but a new type of logistics node, one with greater geopolitical agility compared to the Iranian and Persian Gulf options.

Golden Arrowhead is no magic plug-in solution to tightness in other sweet or light markets. But it is an emerging option, in a world where mobility and optionality is becoming more valuable than mass.

Key takeaways:

• It is not a plug-in substitute for Iranian Light.

• It cannot serve Asia’s full demand profile if Hormuz shuts.

• But it can anchor Atlantic Basin balances, support Western refiners, and absorb diversion shock in global arbitrage.

Most critically, Guyana’s model—offshore modular FSOs with nimble routing—gives ExxonMobil an asymmetric edge in response timing. In energy markets increasingly dominated by risk pricing, that agility is its own form of strategic reserve. Golden Arrowhead’s primary freight corridor will remain USGC and ARA, with potential to participate in heavier Chinese teapot refinery markets with high blending support and VLCC utilisation to match their profiles.

• TD3C day rates diverging from AG physical availability

• Increased Aframax/Suezmax fixtures Guyana–ARA or Guyana–India >20-day voyages

• ExxonMobil trials of Caribbean VLCC loading

• Golden Arrowhead trading at sustained premium to WTI or Brent, despite similar specs

With the first 1-million-barrel lift of Golden Arrowhead scheduled for August 31 to September 1, the market will soon see how this new flow behaves in real-world economics:

• Who lifts it?

• On what vessel class?

• Co-loaded or standalone?

• Delivered to whom, and at what premium?

This first movement will set the tone for VLCC routing potential, blending strategy acceptance, and Atlantic Basin substitution viability, with many of these short-term opportunities heavily dependent on how the market continues to react to the Iran-Israel conflict at play.

illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

Purva Jain

Energy Transition · Energy Management & Efficiency

illuminem briefings

Carbon Capture & Storage · Oil & Gas

Jordi Roca Jusmet

Climate Change · Oil & Gas

Financial Times

Corporate Governance · Oil & Gas

Politico

Public Governance · Oil & Gas

Oil Price

Oil & Gas · Upstream