· 6 min read

To make some sense of the bewildering global economic and political situation at present, it is helpful to Follow the Energy. In this article, I shed light on this in four graphs from "The Economic Decline of the West: Guns, Oil and Oligarchs."

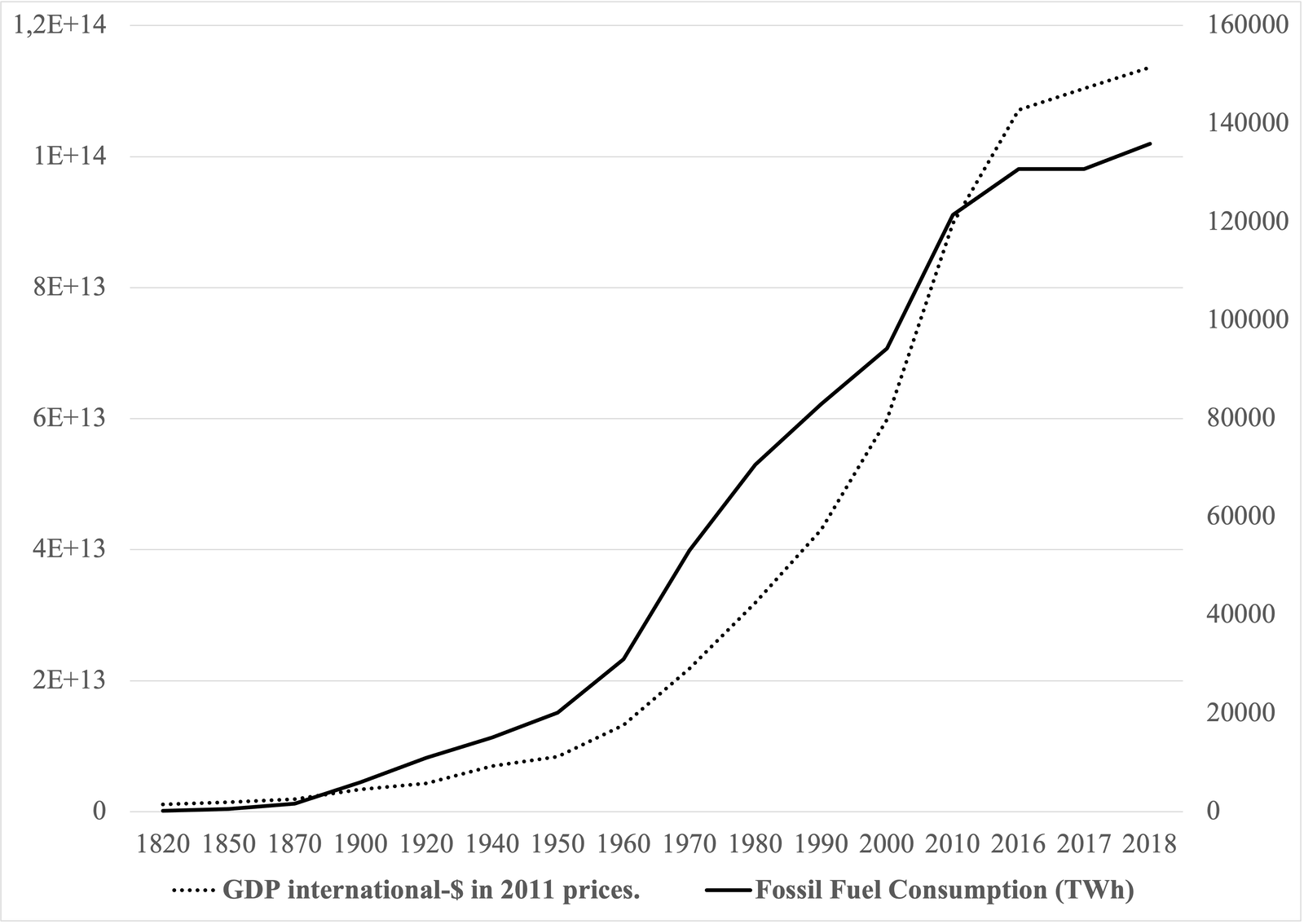

GDP depends crucially on energy

There is a close relationship between global economic output and growth (GDP) and fossil fuel energy. Since around 1820, the exponential rise in world GDP has been largely driven by fossil fuel consumption.

World GDP and Fossil Fuel Consumption, 1820-2018

The first commercial oil wells were drilled in Ontario, Canada, in 1858 and 1859 in Titusville, Pennsylvania, USA. Their impact is clear in the figure above, where GDP shows a noticeable rise around the 1870s. Looking ahead, the era from 1820 to the 2020s will likely be remembered not as the industrial age or the age of entrepreneurship, but as the fossil fuel age.

Now, this fossil fuel age cannot last forever. Peak oil will probably be reached by the 2040s, give and take. But what would happen if the world starts to run out of fossil fuels? Or fossil fuels become more expensive to extract? Since GDP growth relies on increasing fossil fuel consumption, reducing fossil fuel use inevitably slows economic growth - a trend the world dramatically experienced in the 1970s and more recently before the 2008 global financial crisis.

As energy decline, the world will resort to adverse coping strategies

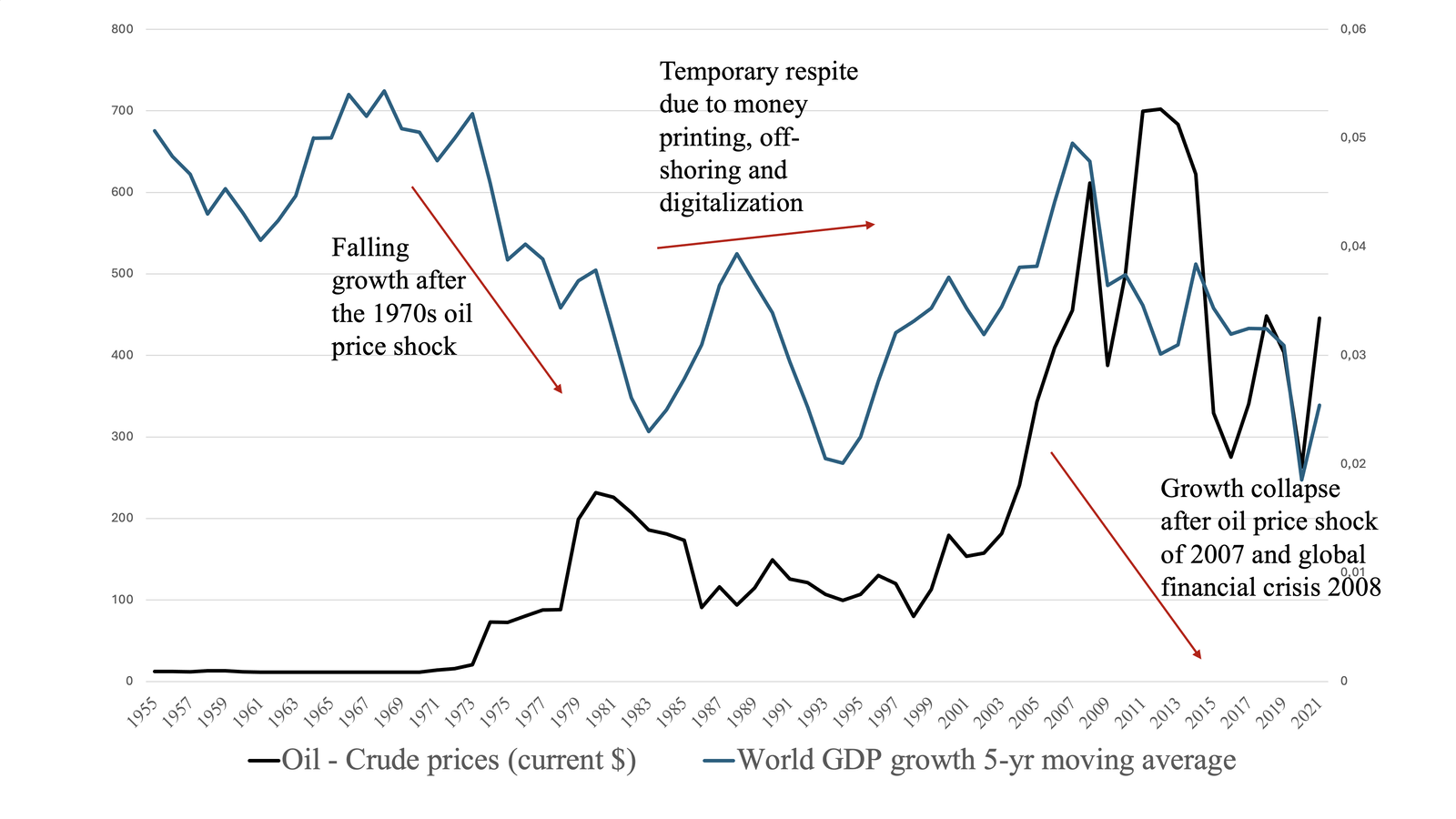

The second graph shows that the post-war period until 1973 was the golden age in terms of plenty of cheap fossil fuels.

Rising Oil Prices Dampens Economic Growth: World GDP Growth and Oil Prices, 1955-2021

However, since 1973, oil prices have been permanently on a higher level and have continued to rise -making a further structural increase to higher levels after 2003. These increases in oil prices are associated with a decline in overall world GDP growth.

For a while, the world enjoyed a temporary respite - from the early 1990s - especially the West where financial sector liberalisation and large-scale money printing by the U.S. kept credit flowing, businesses afloat, and both interest rates and inflation low. So much credit has been pumped into the world economy since the 1970s that interest rates dropped in the past decade to levels not seen in 5,000 years.

The average debt level of the industrial economies rose from 165% of GDP in 1980 to 320% by 2010, which planted the seeds for the Global Financial Crisis of 2007-2009 and still remains a threat to global financial stability: during the COVID-19 pandemic, the US Federal Reserve printed an additional US$4 trillion.

In addition, in the 1970s and 1980s, Western economies started to massively off-shore their manufacturing industries to developing countries where wages and costs were lower to reduce inflation and maintain competitiveness. The emergence of the digital economy following the creation of the Worldwide Webb (WWW) in the early 1990s also gave a respite, but a temporary one as the low hanging fruits of the digital revolution have already been plucked and eaten. With the Enshittification of the internet now in progress, the AI hype is a last grasp to extract some final value from the digital economy.

Fossil fuels are a limited resource that will run out, and the implications for the world economy will, of course, be catastrophic - unless, somehow, the world can find renewable, clean energy sources to replace the oil and gas that we will be running out of. But how realistic is the possibility of finding adequate renewable and clean substitutes for fossil fuels in time?

Around 80% of the world's energy comes from fossil fuels. Replacing so much fossil fuel energy is daunting, and according to many, it is not clear at present whether this is possible. Indeed, the declines in science, research productivity, and innovation do not suggest that there is a cause for techno-optimism.

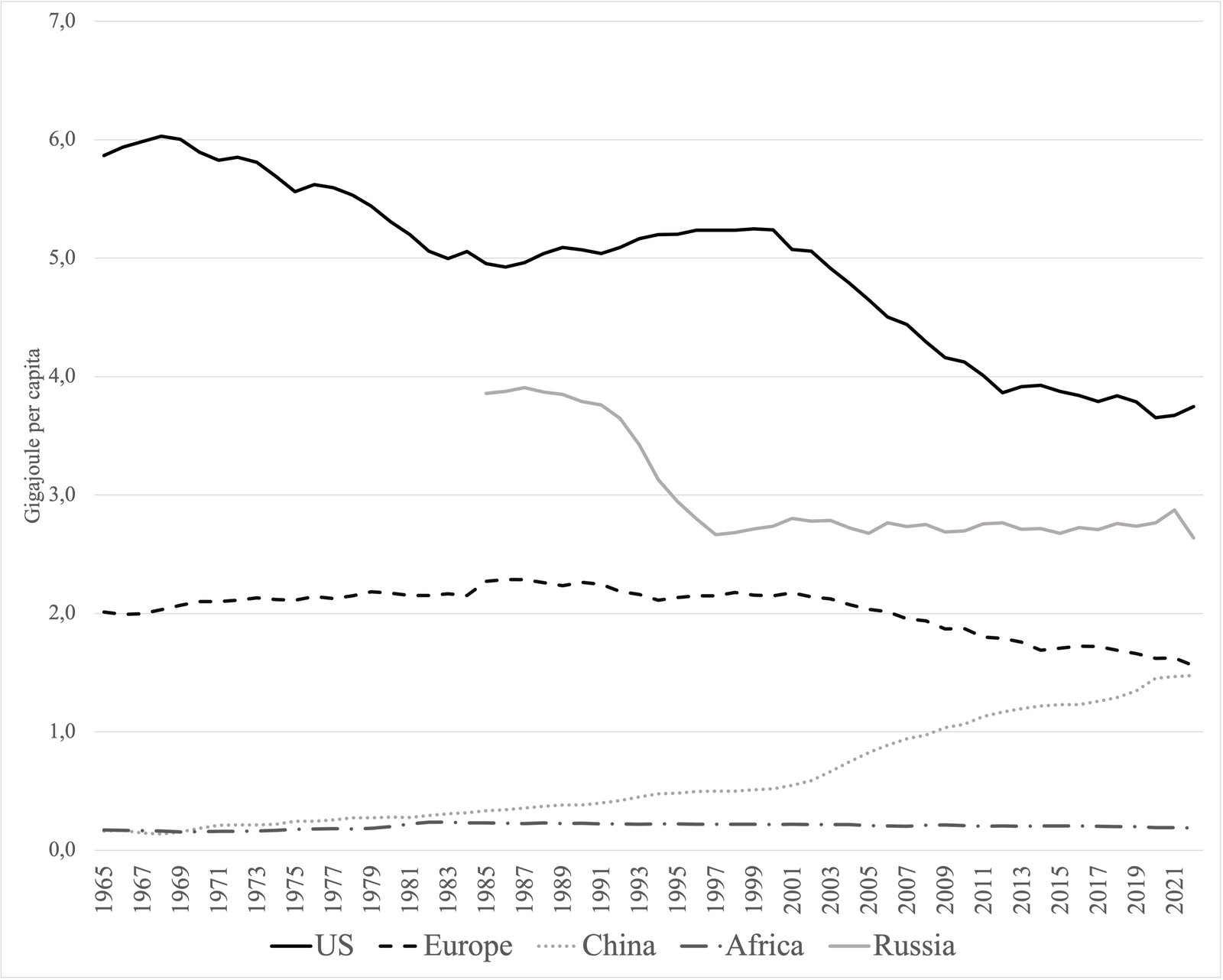

The end of fossil fuels spells the end of western dominance

The third graph shows that the end of the fossil fuel age will see the end of Western hegemony. Blair Fix has argued that an empire's history is written in the language of energy. This is because "a successful empire centralises the flow of energy. This means that energy use (per person) in the empire's core will dwarf energy use in the periphery. The degree to which this is true marks the degree that the empire is successful."

If, following Blair Fix, one plots energy use per capita in the West, the decline in the flow of energy towards the US and Europe is notable in the following figure.

Relative Energy Consumption per Capita, US, Russia, China and Africa, 1965-2022

Since World War II, there has been a steady decline in energy centralisation in the US, with an acceleration from the end of the 1990s. It is perhaps no coincidence that from the end of the 1999s, there was an acceleration in the number of US military interventions abroad. Russia, the second most intensive consumer of energy per capita after the US, experienced a relative decline in its global position after the fall of the Soviet Union, which, however, stabilised after the 2000s.

At the same time, China's ability to obtain and use energy has steadily increased to the extent that it is now about to exceed Europe.

From the US's point of view, the major geopolitical adversaries are China and Russia. If we follow the energy, they are both more successful "empires" than Europe, which is increasingly a spent force from which the US is disengaging.

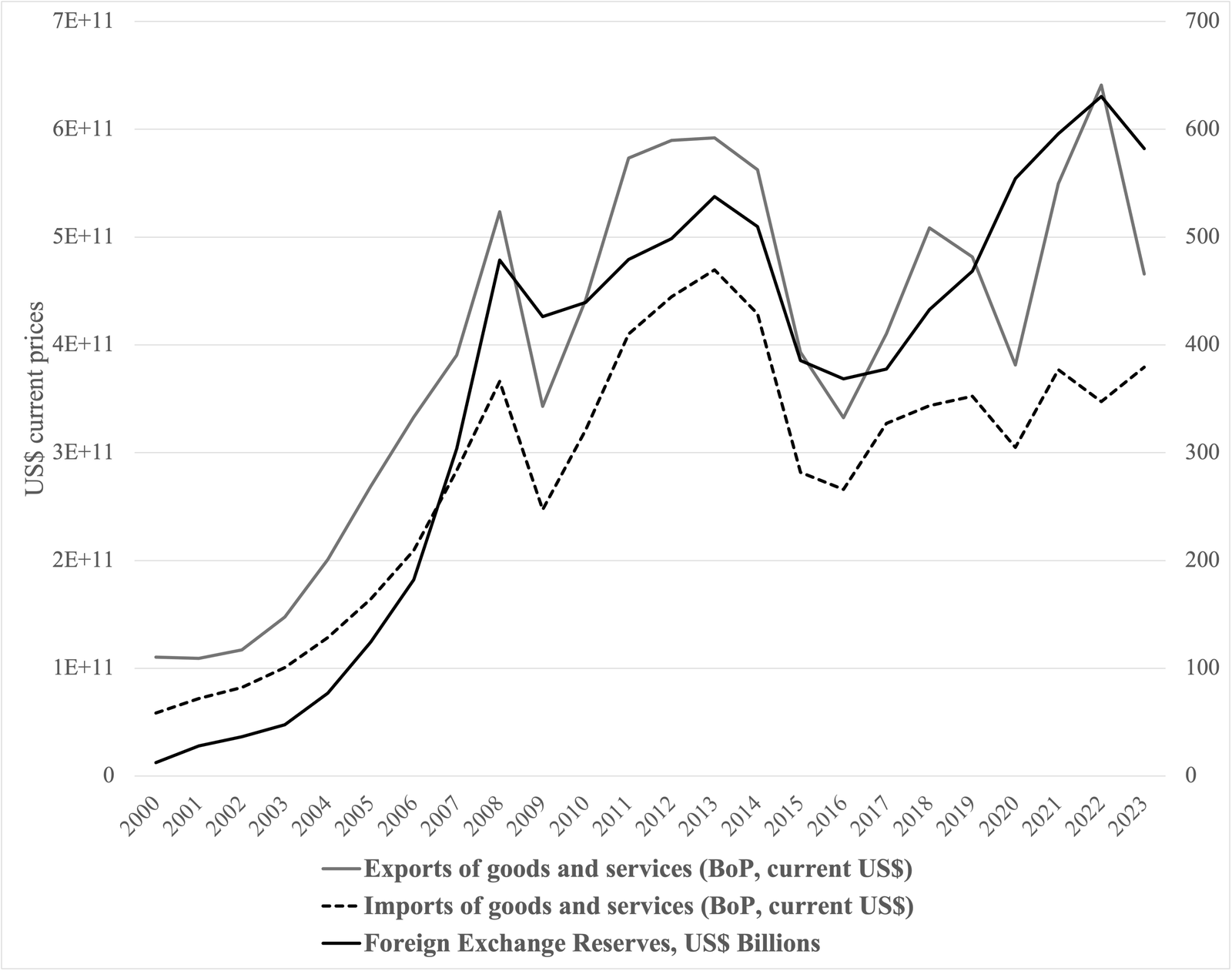

War - While we still have enough oil

The fourth graph shows that countries may, knowing that energy is getting scarcer, bring forward their military ambitions, settle scores, and realise ambitions now - before it is too late. A modern army, after all, cannot fight without fossil fuels. The graph shows the case of Russia.

Russia is one of the world's major producers and exporters of oil and gas. In 2022 and 2023, it exported 12,3% and 11,3% of the world's crude oil daily - around 5,000 barrels. As a result of its oil exports, it has always managed to run a trade surplus, as the figure below shows. By 2022, its foreign exchange reserves were at a historical height. It had a literal "war chest," which emboldened its decision to invade Ukraine that year. It explains why it may outlast a relatively energy-poor Europe in a war of attrition.

Oil Revenue and a War Chest: Russia's Imports, Exports, and Foreign Exchange Reserves, 2000-2023

In conclusion

The global economy and the relative geopolitical power of countries depend crucially on energy - of which 80% comes from fossil fuels. With the end of the fossil fuel era inevitable and approaching, the global economy will continue its lacklustre performance and see the gradual erosion of the relative dominance of the West. These absolute and relative declines will spur adverse forms of coping, including war and fascism. Just read the daily news - and follow the energy - to experience and understand what it is like to live at the approaching end of the fossil fuel age and how the nexus of energy, war and oligarchs contribute to social and ecological decline.

illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.