Training an Energy Decision Agent With Reinforcement Learning

· 6 min read

Real-world reinforcement learning applications are hard to find. This article gives a high-level overview of building an RL agent aimed to optimize the energy use. The article is divided into following sections:

We have an household that generates its own solar energy with 12 kWp unit and is able to store this energy in a home battery (Tesla Powerwall 2 with 13 kWh capacity) which can be controlled through API. The electricity contract of the household is based on day-ahead market prices and the storage device can also be used to participate in aFRR-up/secondary reserve market.

Our goal is to train an agent that minimizes the energy cost of a household by controlling the battery considering the energy markets (day-ahead market, frequency markets), the local conditions (e.g. the baseload of the household) and user preferences (e.g. battery level can’t go below certain threshold).

In reinforcement learning, the agent learns by making actions in an environment, receiving rewards/penalties for those actions and modifying its action pattern (policy) accordingly.

One could either use the real environment (the real household and the energy markets) or simulated environment. In this project, a simulation environment was built, using the OpenAI Gym as a framework.

Developing the simulation environment for the energy decision agent involved the following steps:

In total, the programmatical representation of our environment included ca 700 lines of code (including the helper functions). Next, I’ll explain some of the key parts of the environment.

The state/observation is a numerical representation of the current situation. In our project, this means representing the current state of energy markets, household and the assets.

Our initial (unmodified) observation space consists of the following information:

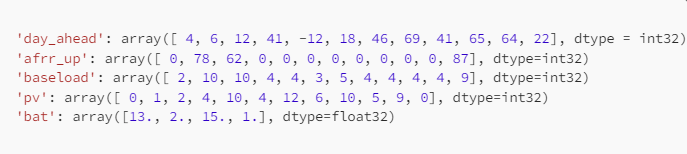

The code block below represents an example of the unmodified observation components: we have 12 forecasted values of day-ahead and afrr-up market prices, the same number of corresponding baseload and pv-product values and 4 values that represent the information about the battery.

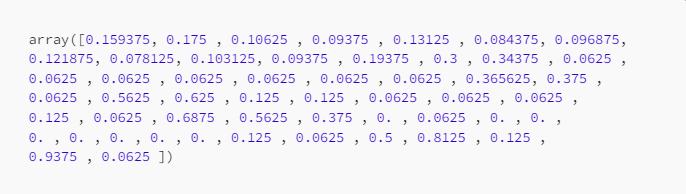

The initial observation representation was modified in order to make it easier to handle by the neural network that our agent uses for learning. Each observation was normalized (represented between 0 and 1) and flattened (given as a single vector instead of five different vectors). The modified observation looks like this:

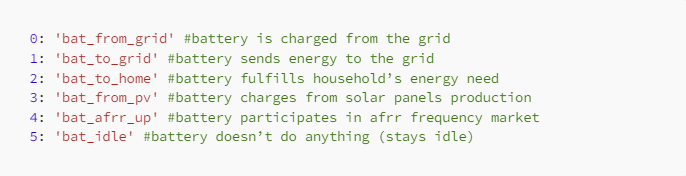

Action space represents the decisions (actions) that the agent can make. Our energy decision agent has discrete action space of length 6.

Each value (from 0–5) corresponds to one of the actions that the agent can do with the battery. Each action affects the State-of-Charge of the battery and has a corresponding cost/benefit.

Complexity: One episode is 24 hours and we have 6 actions to select for each hour. We have 4 738 381 338 321 616 896 (4.7 quintillion) possible ways to use this battery in a single episode.

The agent is rewarded on each step and the reward equals the energy cost that the household experiences. For example, if the agent decides on action value 0: ‘bat_from_grid’, then the maximum possible amount of energy is charged from the grid to the battery and the agent receives the reward that equals to: charging cost + household baseload cost + revenue from pv production + …

The goal of the agent was to maximize the reward for the 24 hours timespan (that is: 24 hours was defined as a single episode).

During the training phase, the agent makes actions in the simulated environment and tries to find the action plan that is monetarily most beneficial to the household. In this project, the agent was represented by the RLLIB’s implementation of the IMPALA algorithm. IMPALA enables to train the agent of multiple CPU cores simultaneously. The setup in this project included 4 cores/workers and 3 environments per worker.

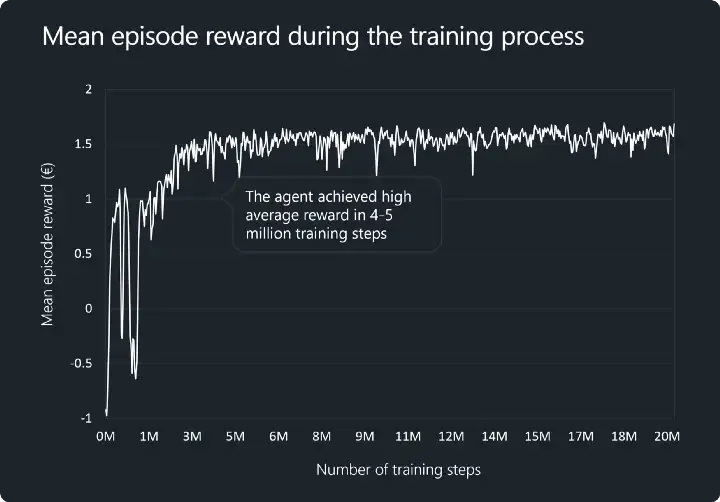

The image below represents the mean episode reward (calculated as a mean of 100 episodes) during the training process. We can see that the agent evolved very quickly but the stability of the policy (its decision pattern) was rather low during the first two million steps of training. At the last stages of the training, our agent was able to consistently retrieve the mean reward of 1.5–1.6 € per episode.

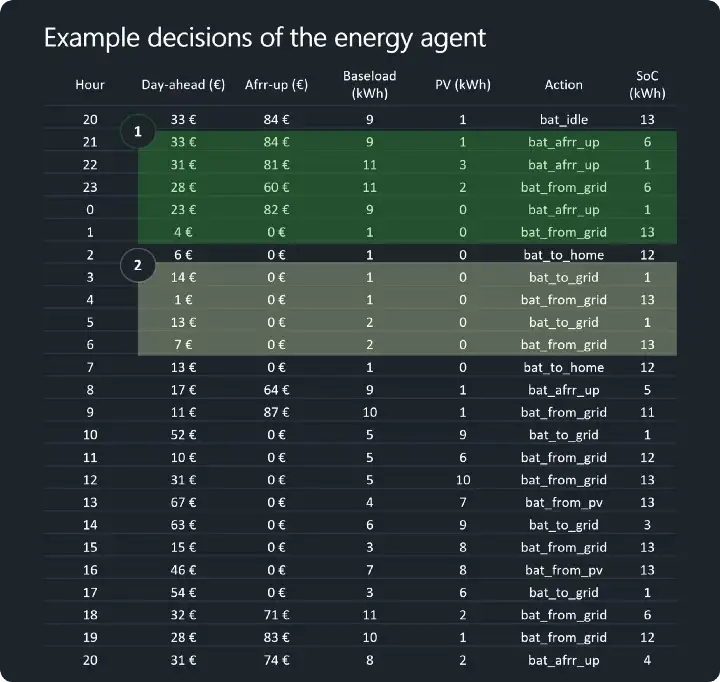

As a final step, let’s take a look at the actions that our agent proposes for a sample 24-hour period (the image below). The Day-ahead and Afrr-up columns represent the market prices on those hours. The baseload and the PV represent the regular consumption and the PV-production of the household (in kWh). The Action column indicates the action/decision that is proposed by our energy decision agent and the SoC column shows the battery level (in kWh) at the end of the hour (after carrying out the proposed action).

The first highlighted region of the table shows how our agent is able to allocate the battery on the afrr-up market during the high-priced hours (hours 21, 22, 0) and charge from the grid during the hours when the day-ahead prices are low (hours 28 and 4).

The second highlighted region indicates the pure market price arbitrage by our agent — discharging with the high-priced hours (hours 3 and 5) and charging during the low-priced hours (hours 4 and 6).

As a conclusion, I would like to highlight the following aspects:

This article is also published on Medium. Future Thought Leaders is a democratic space presenting the thoughts and opinions of rising Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

Yury Erofeev

Battery Tech · Mobility Tech

illuminem briefings

Energy Transition · Energy Storage

illuminem briefings

Green Tech · Carbon

Oil Price

Circularity · Battery

Electrek

Battery · Energy Sources

CNBC

Battery Tech · AI