· 12 min read

Introduction - why is nature important

My analysis begins by analyzing the disruption that has been caused to nature and the role that ecosystems restoration plays to reach the Paris Climate Agreement goals. Nature conservation is a critical area for addressing climate change, alongside renewable energy and sustainable food systems, with over 50% of carbon sequestration solutions stemming from forests and oceans. To understand that we are reaching a tipping point consider that:

• Current global consumption patterns demand the equivalent of 1.7 Earths to sustain them

• Over 50% of the world's GDP is directly dependent on ecosystem services

• 1 million species are at risk of extinction and global biodiversity has declined by 70% since 1970

• 1,692 acres of dry land turn into desert every hour and the world has lost 30% of its forests, equating to an area twice the size of the United States

• Deforestation caused severe disruption of the Biotic Pump mechanism with a negative impact on the water cycle, causing an estimated decrease in annual rainfall by approximately 8% in the Amazon region by 2050

• Humanity has crossed six of nine planetary boundaries: climate change, biodiversity loss, land-system change, altered biogeochemical cycles, freshwater use, and the introduction of novel entities like microplastics

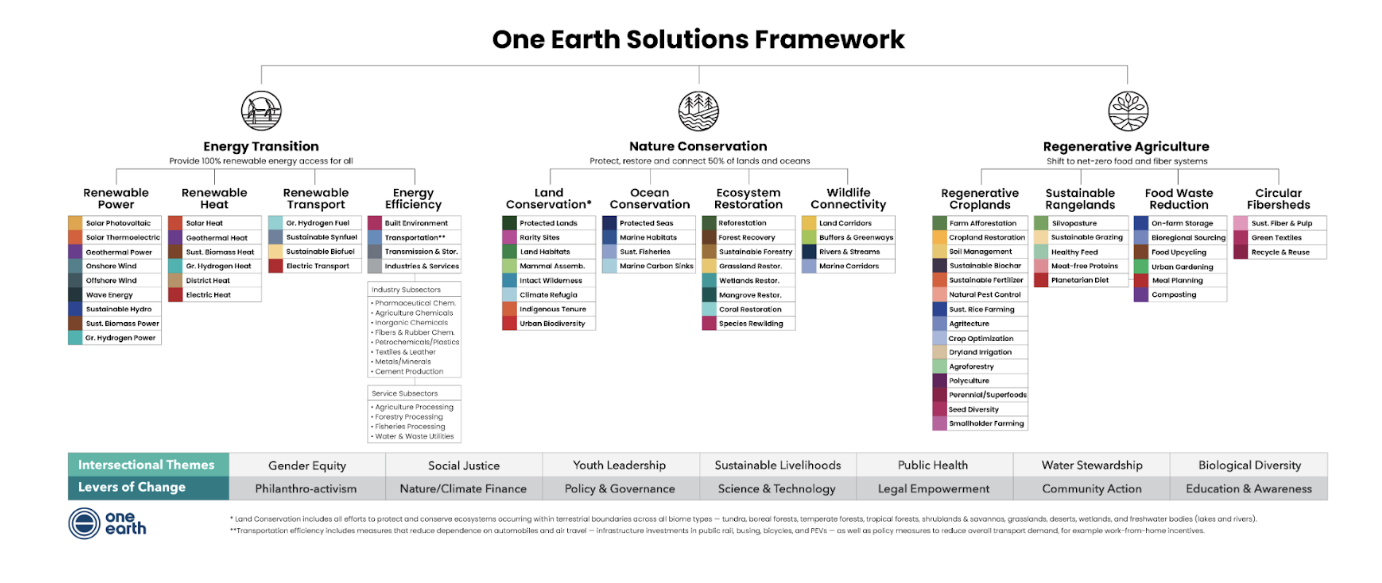

Image source: One Earth - strategic approach designed to address interconnected global challenges such as climate change and biodiversity loss while promoting sustainable development.

Nature finance funding gap

Climate and nature finance involves the allocation of financial resources to mitigate climate change, adapt to its impacts, and preserve or restore ecosystems such as pollination, global food security, availability of clean water, air, and raw materials. I believe it is essential to integrate funding for these services into private-sector capital markets, rather than relying solely on grants and institutional funding. This approach is crucial to achieving the necessary scale of investment, fostering global awareness, and driving the transition to a regenerative economy.

At past pivotal UN conferences, such as UNFCCC COP21 in Paris (2015) and CBD COP15 in Montreal (2022), the global community made initial commitments related to the protection of nature-linked carbon sinks and biodiversity stocks:

• Limiting temperature rise to 1.5°C

• Safeguard 30% of the planet’s surface by 2030

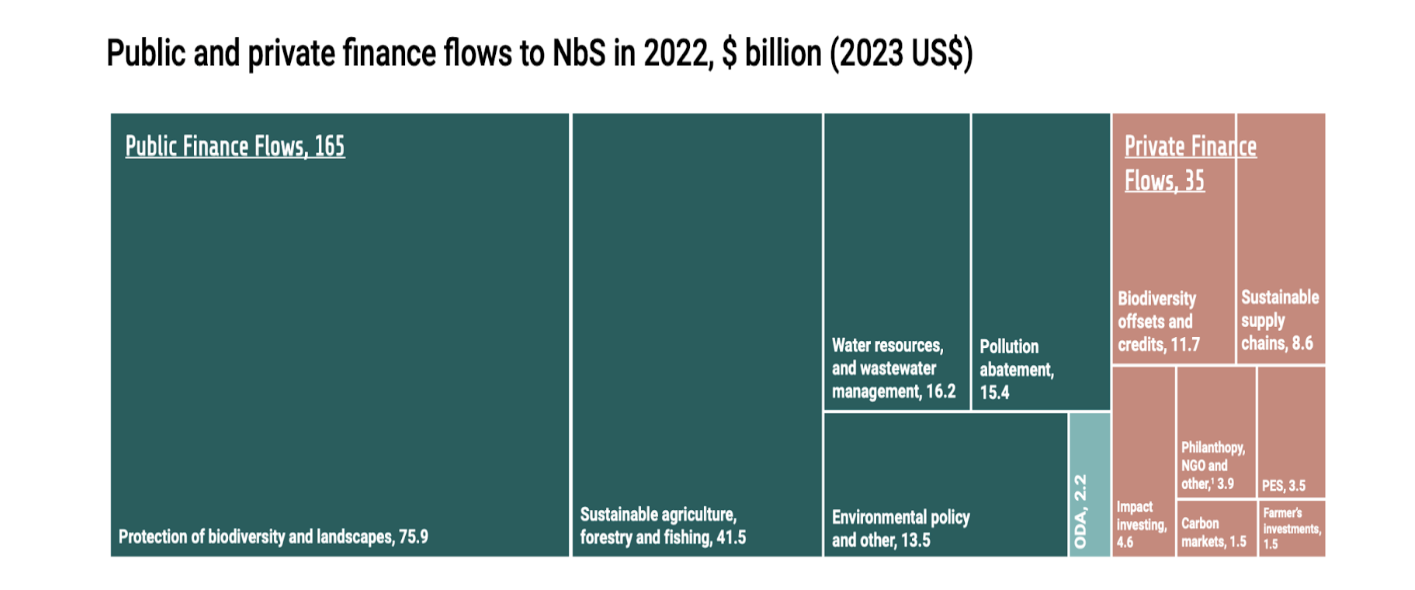

Achieving these targets is estimated to require annual investment into nature preservation and restoration of USD 542-737 billion between 2030 and 2050. This means that it is required to almost triple investments compared to current annual NbS finance flows of USD 200 billion - of which 82% comes from the public sector and 18% from the private sector.

Image source: UNEP

An investment case for the private sector

From the previous figures, it is evident that the private sector's contribution to nature-based solutions remains significantly limited with a nature funding of USD 35 billion in 2022. Historically, nature has been considered an open-ended and free public good, leading to underinvestment and overuse, a dilemma known as “the tragedy of the commons”.

Nature risk

However USD 44 trillion, or about half of the global GDP, has a medium or high dependency on nature for critical ecosystem services. In 2023 a survey of 557 institutional investors with USD195 billion average assets under management across the US, UK, France, Singapore, Japan, and Australia revealed that 46% of them focused on risks posed by nature which could negatively affect their existing investments.

Interesting to mention some data and tools for identifying risks, including:

• InVEST: Quantifies ecosystem services' value and identifies high-risk investment areas based on ecosystem service scarcity

• Exploring nature capital opportunities, risks and exposure - ENCORE: Visualizes industry impacts and dependencies

• Integrated biodiversity assessment tool - EBAT: Assesses overlap with protected areas and species at risk

Sectors identified as highly exposed to nature risks include:

• Agriculture and forestry

• Property and construction

• Chemicals, materials and manufacturing

• Other sectors such as energy, mining, transportation and apparel

Nature opportunity

If nature depletion causes a risk to the private sector, nature markets are also expanding, offering an opportunity for investments which couple nature protection with an economic return. This rising market spans the Asset Market (right to use ecosystems such as agricultural land), Intrinsic Market (agriculture commodities, timber, seafood, minerals), the Credit Market (carbon and biodiversity credits), and Derivatives (nature-based insurance and water rights). Intrinsic markets are considered the largest category valued at USD 4 trillion.

An example of a sustainable financing model related to intrinsic nature markets in the Amazon biome is the Amazon Biodiversity Fund. This fund, managed by Impact Earth and supported by USAID, raised investments for USD 50 million in 2024. It mobilizes concessional capital to fill critical financing gaps in sustainable projects, de-risking smaller, community-focused ventures, and enhancing their attractiveness to private investors. An example in the credit market is the USD 225 million Amazon Reforestation-linked bond issued by the World Bank in partnership with Mombak. A nine-year principal-protected bond which ties returns to the success of reforestation projects, specifically linking investor profits to carbon credits.

Innovative financing mechanisms

We have identified a significant funding gap that must be addressed to scale up investments in nature-based solutions. In the following section, I will outline the key innovations in nature finance that I believe hold the potential to bridge this gap.

• Environmental credits: I found the concept easier to understand through the Measurable Nature Unit (MNU) introduced by African National Parks: a quantifiable metric used to assess the tangible benefits provided by nature-based solutions. MNUs help standardize the measurement of environmental benefits, making them suitable for reporting, trading, or assessing impact. In the broad ecological credits markets, benefits to be quantified through metrics include:

• Carbon storage and sequestration

• Biodiversity, with first biodiversity credits issued by organizations such as SeaTrees and Terrasos through the “Habitat Banks”. I recommend going through Bloom Labs articles to understand how they work

• Plastic, with initiatives pioneered by organizations like Plastic Bank and rePurpose Global, to fund the recovery and recycling of plastic waste

• Water quality and quantity with initiatives being developed by The Freshwater Trust and Viacqua

• Multifunctional forest management, with the example of Climark’s climate credits

• Bioregional funds: funds or “Bioregional Financing Facilities (BFF)”, dedicated to supporting NbS within specific geographic regions. These facilities decentralize financial resource governance, enabling capital to flow directly to regenerative initiatives that align with bioregional priorities and indigenous wisdom. Early application examples include the Salmon Nation initiative or the Hawai‘i Investment Ready (HIR) Initiative, launched in 2013 as the first Indigenous-led social enterprise accelerator in the U.S. The strategy of using place-based, participatory governance spurs from the fact that, despite indigenous people stewarding an estimated 80% of the world's biodiversity on 20% of its land, they often lack the financial resources to scale their efforts. Structured as trusts, venture studios, investment companies, or bioregional banks, BFFs aggregate diverse funding streams

• Blended finance: Combining concessional (public) and market-based (private) capital to de-risk investments and attract private capital. It often works through Decentralized Financial Institutions (DFIs) which provide guarantees, long-term loans, equity investments, grants, and technical assistance. Examples include the Reforestation Fund which received USD 55 million, including USD 40 million in concessional capital as a first-loss tranche to attract private investment and the UK funded program Partnership for Forests, managed by Palladium. This initiative implements three inter-connected strategies aligned with the primary land-use archetypes present in tropical landscapes globally to:

• Increase the value of standing forest by strengthening economically viable alternatives to monoculture

• Work with sustainable cattle ranching and the expansion of soy cultivation into previously deforested areas following a “product-protect and deforestation drivers tackle approach”

• Restore landscapes where the soil has been degraded through sustainable timber and agroforestry systems

• Green bonds and debt-for-nature swaps: the former referring to issuing bonds specifically to finance environmentally friendly projects, and the latter to financial transactions in which a portion of a developing country's foreign debt is forgiven in exchange for commitments to invest in local environmental conservation projects, as it happened in Belize in 2021

• Nature equity management: The Land Banking Group has developed a scalable platform enabling fiduciary-grade nature claims. The system works considering nature as an outcome-based asset class issued with measured indicators as an underlying. Two important elements of this tool include Nature Equity Contracts, legal agreements between land stewards and investors which define measurable ecological outcomes (e.g., carbon sequestration or biodiversity improvement) and Natural Capital Accounts (NCAs), digital records of ecological data (carbon, soil, water) to ensure accountability and transparency

• Conservation finance: approach used by National Parks. Let's consider for example Virunga National Park in the DRC where several market-based approaches are used to diversify revenue streams. These include selling products derived from its natural resources, such as chocolate, coffee, and energy generated by hydroelectric plants, which has even been used to mine Bitcoins

• Regenerative finance (Re-Fi): Unlike traditional finance, which often extracts value from natural and human resources, Re-Fi seeks to create positive environmental, social, and economic outcomes. It leverages blockchain technology, smart-contracts and decentralized finance (DeFi) to fund impactful projects in a transparent and inclusive way. A notable example within this space is Gitcoin's Quadratic Funding model, which democratizes funding decisions by matching individual contributions to projects in proportion to their popularity, de facto amplifying the impact of contributions from many small donors over that of a few large donors

• Digital sequence information (DSI): a new finance mechanism launched at COP16 to ensure equitable benefit-sharing from the commercial use of DSI derived from genetic resources. Under this initiative, companies - particularly those in the pharmaceutical, biotechnology, and animal and plant breeding industries - are required to contribute a percentage of their profits or revenues to the Cali Fund. This fund aims to support biodiversity conservation and sustainable development globally. Initial estimates suggest that this mechanism could generate approximately USD 1 billion annually

• Stakeholder coalitions: collaborative action is key in addressing the global nature crisis. Nature coalitions unite diverse stakeholders, including governments, NGOs, businesses, and communities, to:

• Develop standardized methodologies and tools for assessing and valuing NbS

• Facilitate knowledge sharing and capacity building

• Promote innovative financing mechanisms and de-risk investments

• Advocate for policies that support the scaling up of NbS

Some key examples include:

• LEAF coalition: a public-private partnership that aims to halt tropical deforestation by 2030 by facilitating transactions related to REDD+ projects. In 2024 the LEAF Coalition announced a major deal with the Brazilian state of Pará. This is one of the largest carbon credit deals ever signed

• Symbiosis coalition: a tech-driven carbon removal collaboration of tech giants including Google, Meta, Microsoft, and Salesforce, focusing on buying high-quality carbon removal credits from nature restoration projects. The goal is to remove up to 20 million tons of carbon dioxide by 2030

• Coalition for private investment in conservation: A multi-stakeholder partnership to unlock private sector investment for biodiversity conservation and sustainable land management, focused on developing innovative financial mechanisms

Future trends

The growing recognition of the importance of nature capital to combat climate change is expected to drive significant changes in how environmental resources are managed and valued. Here are some trends that I consider important to follow:

• Regulatory pressure: Within the near future businesses may be mandated to further disclose nature-related dependencies and impacts (e.g., EU Deforestation Regulation) and held accountable for lack of company disclosures and project traceability

• Policy reforms: specifically focusing on negative finance flows, reallocating funds toward NbS, and governments and multilateral institutions anchoring biodiversity targets and climate commitments into national policies. Negative finance flows include public spending on environmentally harmful subsidies, estimated between USD500 billion and USD1 trillion annually, and private financial flows harmful to biodiversity, with USD2.6 trillion of potentially nature-negative investments annually, if we consider the portfolios of the 50 major banks in the world

• Asset class potential: 75% of investors believe some nature-related investments could become distinct asset classes

• Nature as an infrastructure: This is easier to understand through an example. Instead of valuing trees in an isolated way in relation to a single measurable outcome (timber or carbon sequestration) which can be traded in markets, consider them as part of an interdependent system also to reduce the urban heat or manage stormwater by intercepting rain. This model considers the role of nature to deliver a range of essential services that would otherwise require engineered solutions: cooling systems, drainage networks, air purification

• Nature-tech: Technologies that can be a game-changer in monitoring and accelerating the impact and effectiveness of NbS, including blockchain, AI and machine learning, remote sensing, drones, bioacoustics, environmental DNA and bio-boosting-system

Conclusion

The critical role of natural capital in mitigating climate change, preserving biodiversity, and maintaining global economic stability cannot be overstated. With approximately 50% of global GDP dependent on ecosystem services, and a natural financing gap requiring annual investments of USD542–USD737 billion through 2050, the need for transformative financial strategies is evident. The private sector current investment of only USD35 billion underscores the significant undercapitalization of this vital resource.

Innovative mechanisms such as carbon and biodiversity credits, bioregional financing facilities, and regenerative finance models offer scalable solutions to address this disparity. Furthermore, public-private partnerships, exemplified by initiatives like the LEAF Coalition and the Amazon Reforestation-linked bond, demonstrate the potential of collaborative efforts to mobilize capital. Achieving global targets - such as limiting warming to 1.5°C and protecting 30% of the planet by 2030 - requires a paradigm shift in how nature is valued, funded, and integrated into economic systems. With humanity already surpassing six of nine planetary boundaries, the imperative to align financial flows with ecological priorities is not just a moral responsibility but an economic necessity. By leveraging these strategies and scaling investments, we can pave the way for a resilient, regenerative global economy.

illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.