The Carbon Border Adjustment Mechanism (CBAM): Strategic and financial implications

· 8 min read

On October 1, 2023, the EU's Carbon Border Adjustment Mechanism (CBAM) came into effect. CBAM fundamentally changes global trade in CO₂-intensive products. Since October 2023, importers of iron & steel products have to report embedded emissions in their products. Starting with imports in 2026, importers will also have to pay for the emissions contained in the imported products – a development with far-reaching implications for procurement, risk management, and supply chains. The potentially significant financial risks for producers, industry, and traders can be mitigated with forward-looking strategies.

At the end of February 2025, the EU Commission proposed changes to the CBAM regulation, which are not implemented yet, but will likely be adopted during this year. This article incorporates changes due to the proposed changes where relevant.

CBAM aims to reduce the relocation of industries subject to the European Emissions Trading System (EU ETS) to regions with lower environmental regulations. In the EU ETS, companies at risk of carbon leakage receive free emission allowances based on their emission intensity relative to a sectoral benchmark. This mitigates the competitive disadvantage of European climate policy. The allocation of free emission allowances will be gradually phased out by 2034 and is replaced by CBAM. CBAM currently covers six sectors: iron & steel, aluminum, cement, electricity, fertilisers and hydrogen, where CBAM-liable goods are defined via the Combined Nomenclature (CN) tariff numbers.

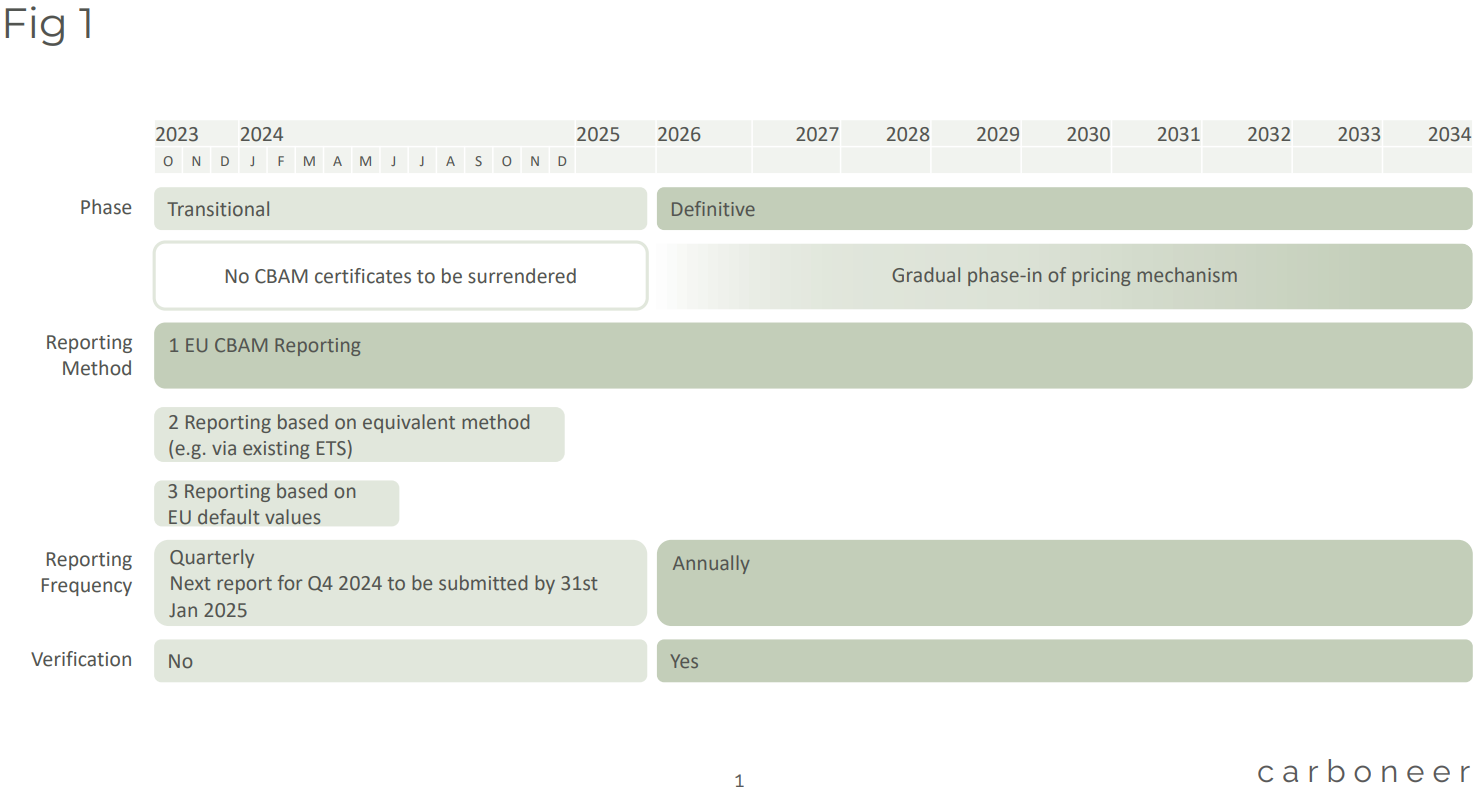

During the transition period from October 2023 to the end of 2025, CBAM is limited to reporting obligations (Figure 1). Importers or indirect customs representatives introducing CBAM goods into the EU are required to report the embedded emissions in their products. They rely on producers in non-EU countries for the emission data.

The regular and definitive phase of CBAM begins in 2026. From this point, importers must report verified emission data or use higher default values for imported goods and purchase CBAM certificates for imported emissions. The price of CBAM certificates is linked to the price of emission allowances in EU ETS, which stood between 50-80 EUR per ton of CO2 equivalent during much of 2025. Any CO2 price already incurred in the countries of origin can be subtracted, reducing the number of CBAM certificates to be surrendered. This mechanism aligns the CO2 price for foreign and domestic goods sold in the EU market.

From 2026, authorised CBAM declarants must submit annual CBAM declarations instead of quarterly CBAM reports during the transitional phase. The CBAM declarations contain information about the CBAM goods imported in a calendar year and must be submitted by August 31 of the following year. Along with the declarations, importers must hand over CBAM certificates for each ton of imported emissions to the national authorities. The exact number of CBAM certificates depends on verified emissions of importer products, default values with a mark-up for data gaps and CBAM benchmarks, the latter two not published yet.

Importers must purchase and hold CBAM certificates by the end of each quarter representing 50% of imported emissions during the import year (exception: 2026 for which CBAM certificates can only be purchased between February and August 2027). The price of CBAM certificates is calculated from the average weekly price of allowances in EU ETS. Prices for emission allowances in EU ETS can fluctuate significantly. Due to EU climate policy, prices are expected to rise significantly in the medium to long term and to range between 120 and 200 EUR/tCO2 by 2030. Combined, these factors pose a challenge for accurately estimating CBAM certificate costs.

From the perspective of an importer, it is advantageous to know future CBAM costs today and when payments are due. Otherwise, the strategic relevance of the issue and the impact on risk and liquidity management of this additional financial burden may be misjudged. A solid forecast of expected costs enables:

• Planning the budget for purchasing CBAM certificates,

• Developing a purchasing strategy for acquiring CBAM certificates to avoid buying at peak prices,

• Understand price uncertainties of CBAM certificates and thus costs for imported goods,

• Adjusting supplier and customer contracts to avoid bearing CBAM costs alone,

• Integrating the impact of CBAM into strategic purchasing decisions.

To illustrate the approach, an annual import volume of 100,000 tons of steel ingots is used in the following case study.

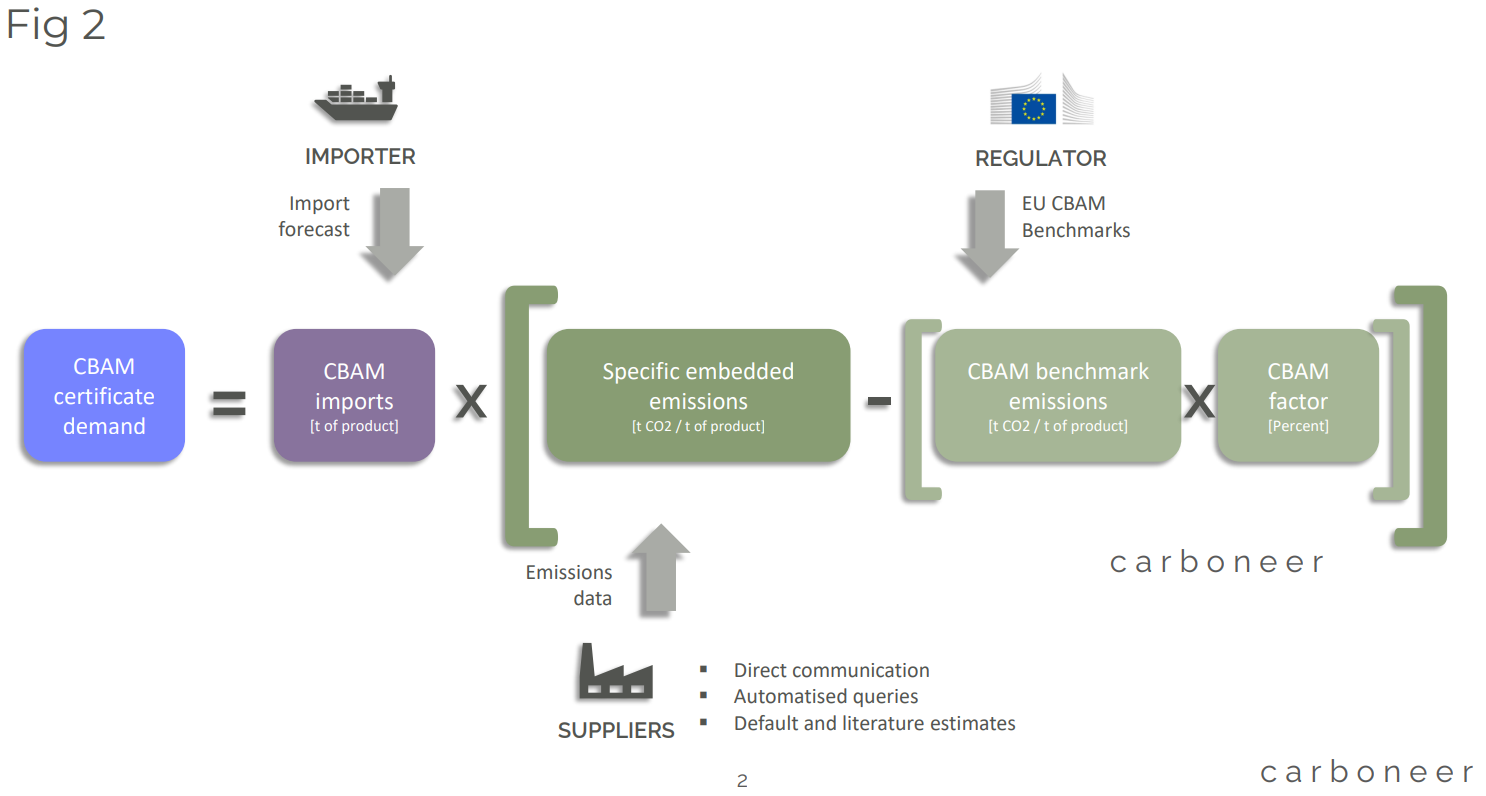

Calculating the number of CBAM certificates to be surrendered for importing goods within a calendar year is the starting point for further analysis. For simplicity, we assume that no CO2 prices were paid in the upstream supply chain. Figure 2 shows the key parameters of the calculation formula.

CBAM benchmarks are expected to be published in Q4 2025 and will be based on the benchmarks for determining free allocations in EU ETS. While CBAM benchmarks will be officially announced relatively shortly before 2026, a good estimate of CBAM certificate demand through scenario analysis is possible already today.

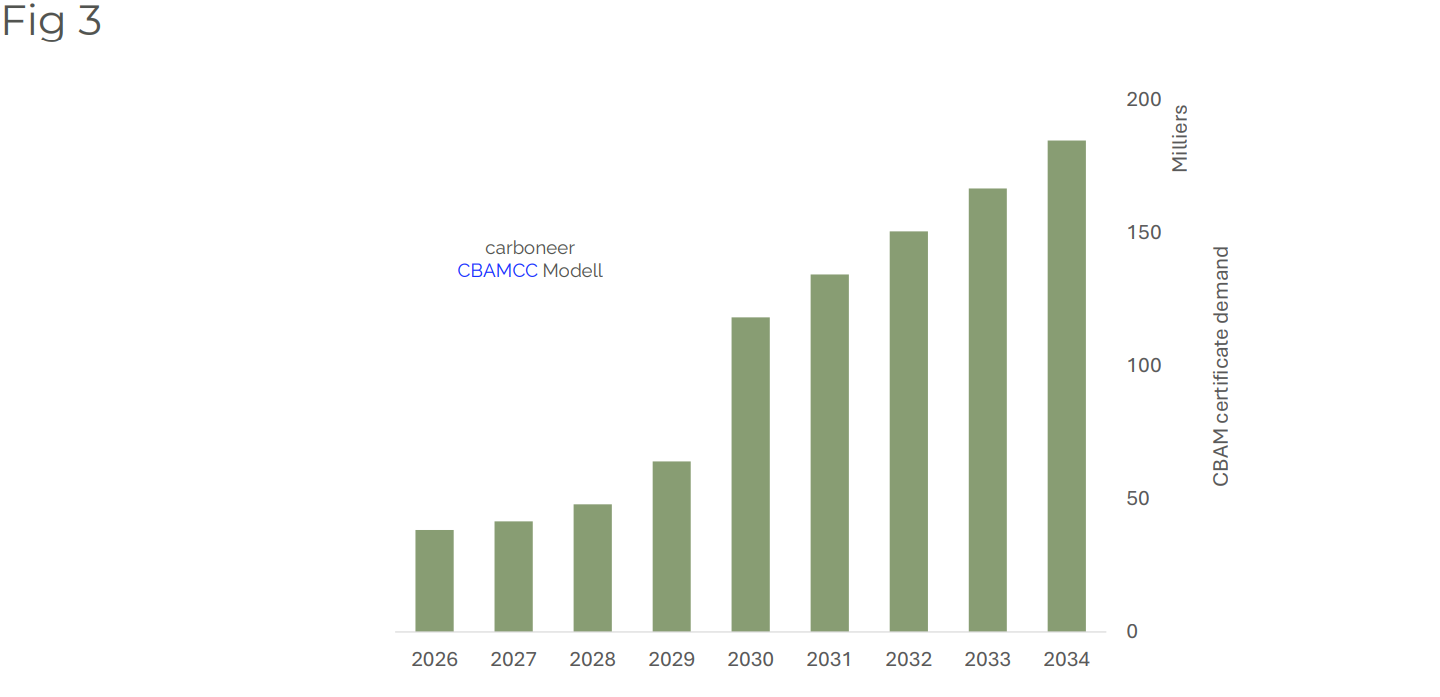

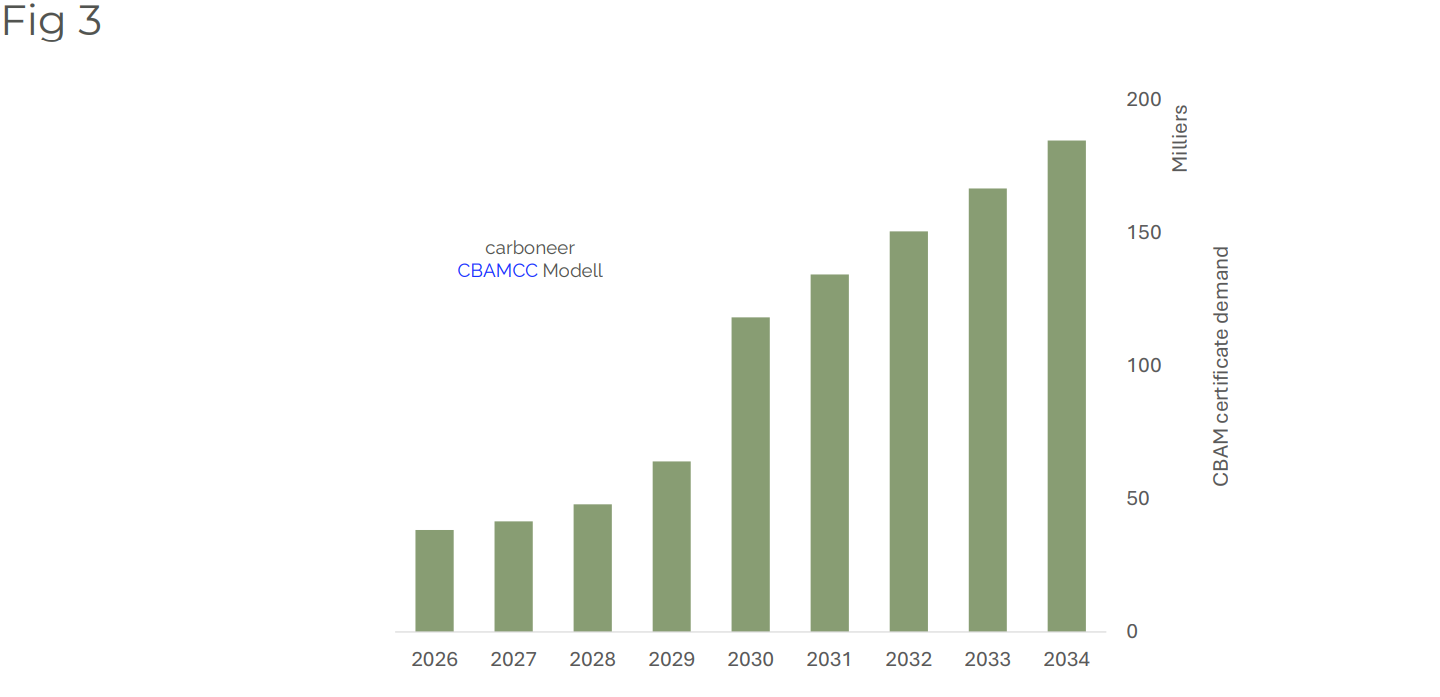

In our case study, the quantity of CBAM certificates to be acquired annually by the importer rises from over 130,000 for its imports in 2026 to more than 300,000 in 2034 (compare Figure 3). Depending on the emission intensity of the imported products, a significant share of imported emissions can thus already be priced at the start of the definitive phase. An analysis per import, CBAM good, and supplier can provide insights into important metrics such as absolute and relative contribution to CBAM certificate demand.

The annual costs for CBAM certificates with constant import volumes of the case study can now be estimated. Forecasts and scenarios for prices of emission allowances in the EU ETS are used for this purpose, as CBAM certificate prices are formed on a rolling basis through the weekly average of EU ETS auction prices. The carboneer CBAMCC model uses projections from various fundamental EU ETS price models and publications. The projected costs for CBAM certificates are shown in Figure 4, with the uncertainty in EU ETS prices illustrated by the bars.

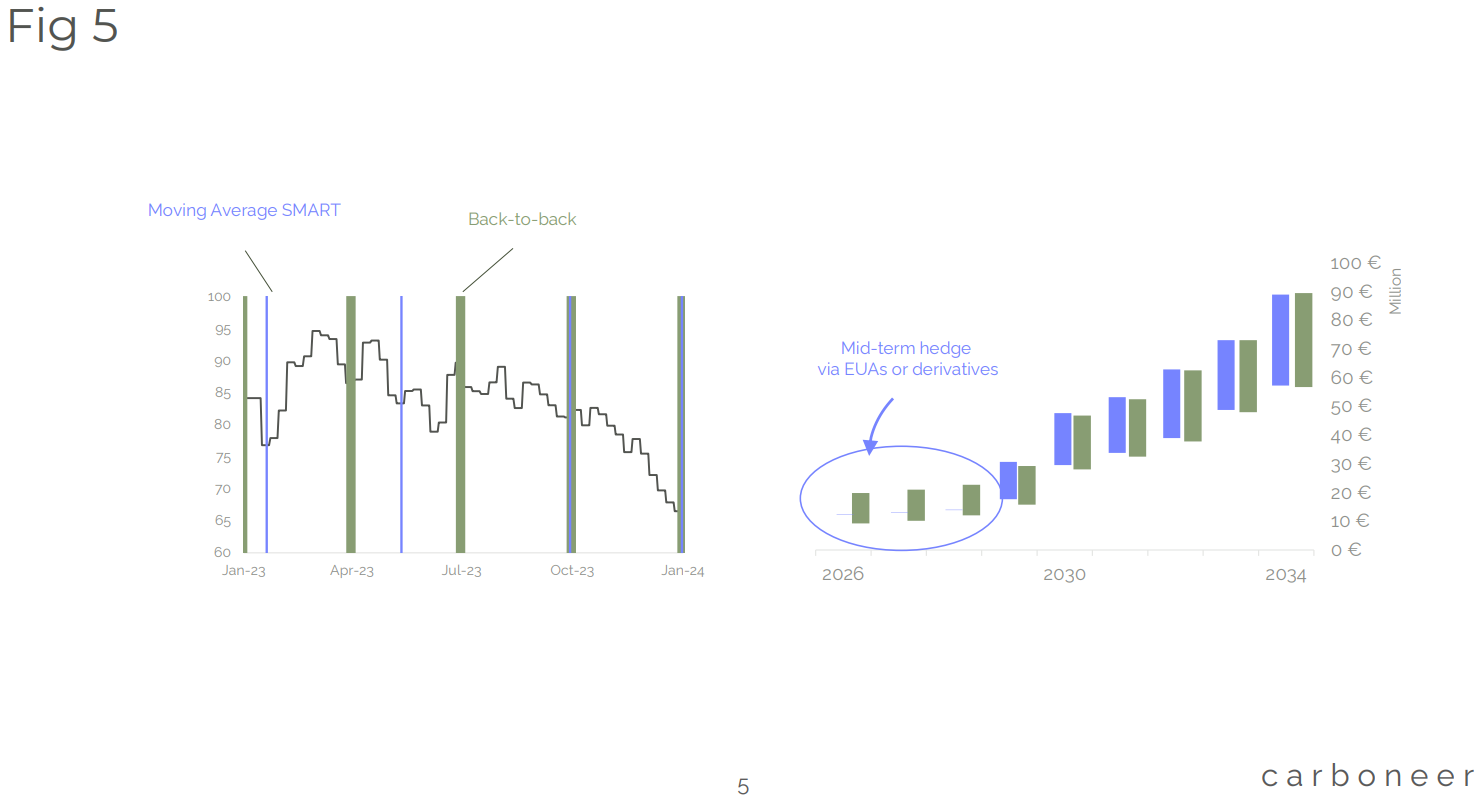

The costs for CBAM certificates for the imports from 2026 to 2034 increase from roughly 10 million EUR to 25-45 million EUR in 2030. Depending on the emission intensity of the imported products, this can lead to price increases of 10-30% for imported products made of iron or steel as early as 2026 and 2027. CBAM certificates are neither tradable between companies nor bankable long-term. Therefore, affected companies should prepare by developing a smart procurement strategy for CBAM certificates, for example, using technical signals to evaluate purchasing decisions. It is also possible to hedge costs by purchasing emission allowances in the EU ETS. These allowances can be resold at the time of CBAM certificate purchase, enabling medium- to long-term hedging of CBAM costs (see figure 5 as examples).

Our analyses show that strategic procurement of CBAM certificates can save up to 10 % of costs. It is also possible to hedge CBAM certificate costs by purchasing emission allowances in the EU ETS. These can be resold at the time of the CBAM certificate purchase and thus enable medium to long-term hedging of CBAM costs (see examples in Figure 5).

For effective risk and cost management a strategic approach should consider company-specific characteristics concerning:

• Liquidity constraints and risk profile,

• Potential for cost pass-through in the supply chain,

• Planning and purchasing/import processes and periods,

• Price volatility in EU ETS.

CBAM obliges importers of certain products to report emission data from the supply chain and, for imports from 2026, to pay a CO2 price corresponding to EU ETS for the imported emissions. CBAM is not just a regulatory issue – it changes global trade. However, companies can prepare for the changes through well-founded cost analyses, strategic procurement, and intelligent price hedging.

CBAM remains subject to significant regulatory uncertainty and dynamics: several legal acts are still expected to be adopted in 2025. Therefore, some of the deadlines or rules mentioned above may still change. A decision to extend CBAM to additional sectors and further downstream products of affected sectors is also pending in the coming months. The determination of emission data in traded products, their efficient communication in the supply chain and understanding cost implications will play an increasingly important role in the coming years.

Explore carbon credit purchases, total emissions, and climate targets of thousands of companies on Data Hub™ — designed to compare the sustainability performance of thousands of companies and to help sustainability providers generate sales leads!

illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

illuminem briefings

Carbon · Environmental Sustainability

illuminem briefings

Public Governance · Carbon Regulations

Lukas May

Carbon Market · Carbon

Euractiv

Carbon Market · Public Governance

Carbon Herald

Carbon Removal · Corporate Governance

CBC News

Carbon Market · Public Governance