Managing the uncertainty of Carbon Dioxide Removal

· 11 min read

Two years ago, when the world shut down for an unknown microscopic enemy, I had just started my CO2 removal start-up, Out of the Blue. As I struggled to make sense of what was happening, and what effect it would have on my business, I set out to make an uncertainty model — inspired by an article in the McKinsey Quarterly that regained traction during the pandemic. Now, the world is shaken up by a terrible war in Ukraine. Again, this global issue will have wide-ranging effects on all facets of the economy, among them on the sector I’m still active in, that of CO2 capture and removal.

I didn’t publish this model before because I thought it was too limited, but when I was going through the document recently, I was surprised by how much my model captures the spirit of today.

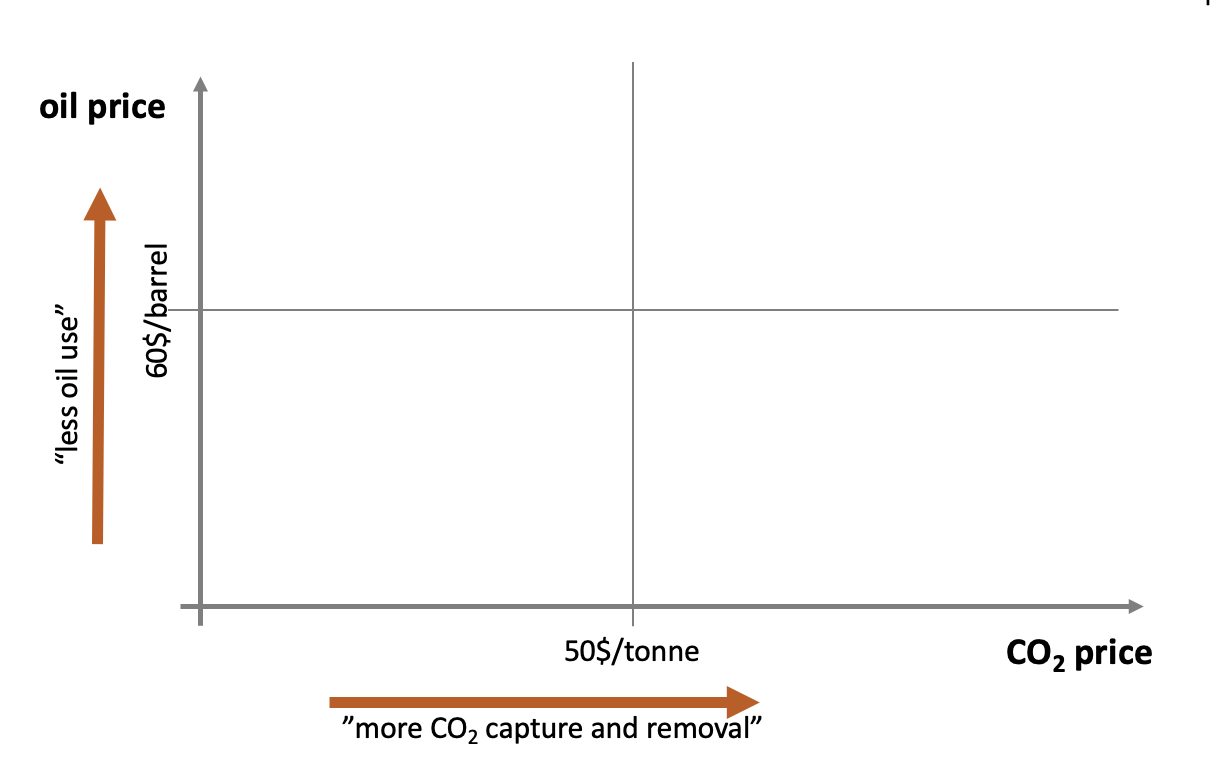

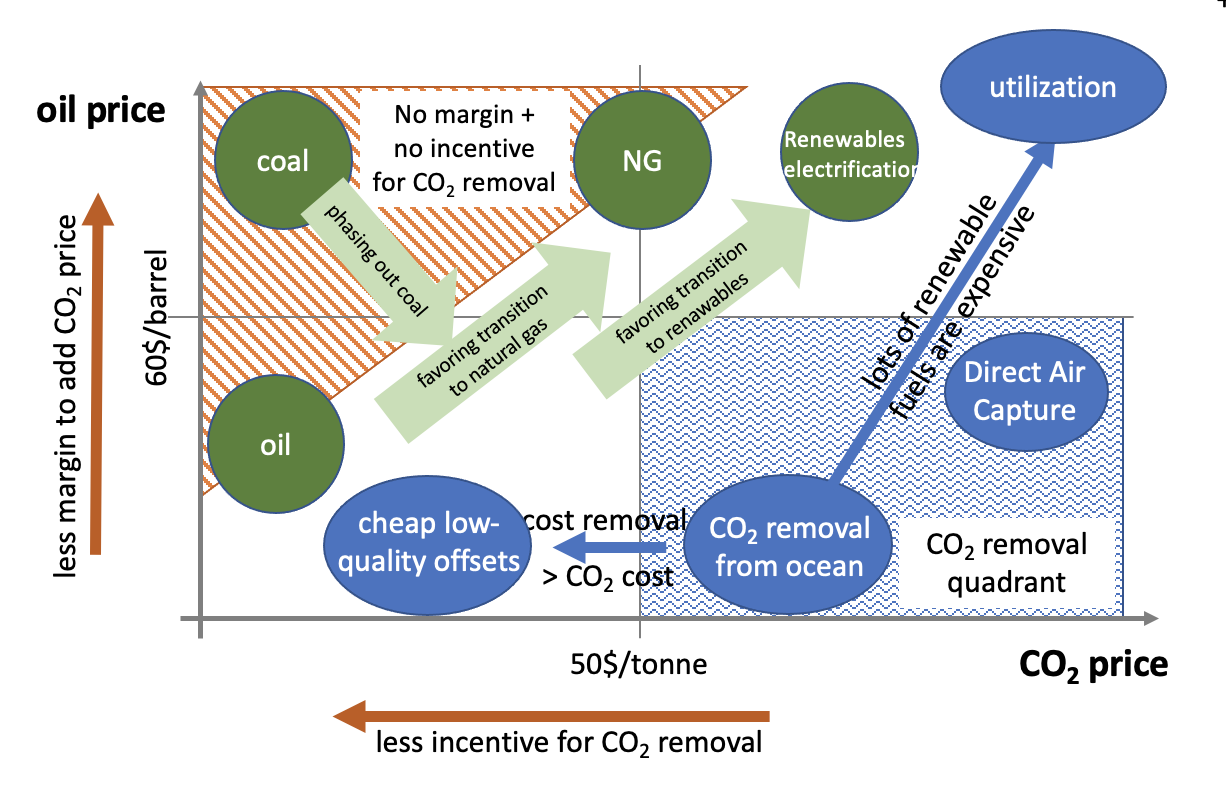

There is this simplistic notion that a high price (or tax — later more on that) on CO2 automatically guarantees an increase in energy efficiency programs, and the deployment of CO2 capture and removal technologies. Moreover, it’s tempting to think that if the price of oil is high enough, businesses and individuals alike will have no choice but to use less of it. While both axes are indeed crucial, this independent 2D model is too simplistic. Time to dive in deeper.

Let’s start with the y-axis, the oil price.

The oil price is a good measure for the price of energy in general. Only looking at the yearly CO2 emissions makes it clear that whatever the price of oil, gas or coal, the overall demand is only going up (although temporarily, the preferred fossil fuel mix may change). Oil demand in particular has very low demand elasticity: no matter how expensive, there is only that much oil the current economical system can realistically save.

The world relies so heavily on cheap energy, and hence, on cheap oil, that you’re running into some mindblowing facts:

Carbon removal in particular needs significant amounts of (carbon-free) energy, not just to build the infrastructure, but also, to run it. The problem is, that is energy is getting scarcer (and hence, more expensive), it is also more expensive to run the CO2 removal process. Moreover, if the general public is already paying more for energy (and all energy-intensive products), there is less support for additional price increases to clean up after the emissions.

In short: a higher oil price says little about the oil use and generally means less breathing room for CO2 removal.

On to the x-axis, the “price” or tax on CO2.

[Note: For the sake of this article, I’m not going into the intricacies of price versus tax: the mechanisms and implementations of these two are vastly different, even between countries or states. However, what’s important is that large entities (corporates, governments) have to pay a price on CO2.]

Conventional wisdom dictates that the higher the price on CO2, the less CO2 will be emitted. I argue that in a lot of cases, it is actually more appropriate to think the other way around:

The higher the price on CO2, the more CO2 is currently being emitted and the stronger the belief that CO2 emissions are only going to rise.

Why else would you pay such high prices if it wasn’t because you desperately wanted to emit it?

One way of looking at it, is that a lot of the CO2 price mechanisms work with a cap-and-trade system, where companies are allowed to emit a certain amount of CO2 (the ‘cap’, which is lowered over time), and can trade the rest. If all companies were perfectly aligned with the decrease of the cap, then the price of the remaining credits wouldn’t rise (or even become lower). Another way of looking at it, is that in an ideal world, there wouldn’t even be a need for such a mechanism: superfluous CO2 emissions wouldn’t exist, and whatever need for CO2 there was (e.g. kerosine for air travel), could be met with circular technologies.

The high CO2 price is not a direct incentive to increase energy efficiency or to build more carbon capture infrastructure, in fact, it is a sign that too little infrastructure was built in the past. At any point in time, it remains a matter of financial risk: do we as a company spend billions of dollars on a project now, in order to save money several years from now?

This is complicated by the fact that a CO2 tax is often just a purely symbolic accounting trick. Carbon dioxide is not traded like bulk commodities (plastics, grain…) or discrete items (phones, cars…). The majority of the CO2 traded is “CO2 not emitted”: big polluters paying slightly-less-big polluters to emit CO2 in their stead.

On top of that, there is a myriad of fossil fuel subsidies, which are effectively lowering the carbon price (You could also argue that the subsidies are lowering the net oil price, but given that the oil question is supply-driven, I think the subtraction is better done from the carbon price). Anyway:

It’s better to talk about the effective or net CO2 price.

Here’s why, using the example of the European Union’s ETS market (the largest CO2 market in the world)

While these numbers are anecdotal at best, and definitely need to be refined, it is clear that the CO2 price is far from the price paid at ETS trading, and it could be argued that the effective or net price of CO2 is much lower than the current price.

Bringing it all together, the following picture appears:

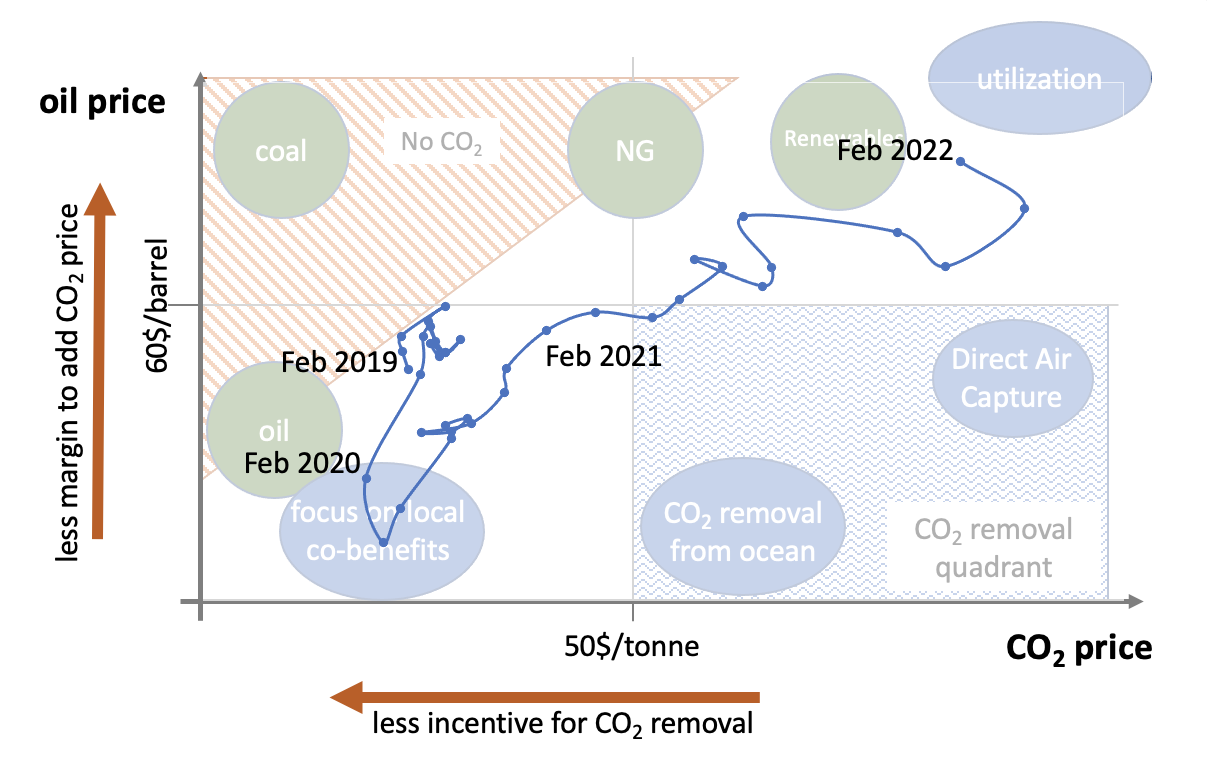

Finally, let’s see how the position in this field evolved in the last 3 years. To do this, I’ve take the monthly average oil price and ETS CO2 price. The European Trading Scheme is the largest public market of CO2 emissions.

The year before the COVID-19 pandemic, we were in a situation where oil was cheap, and the CO2 price was too low to do much about CO2. However, there certainly was a phase-out of coal, and a move towards natural gas happening.

Then the pandemic made the oil price collapse (do you remember the negative oil prices, where oil storage was getting saturated?). Initially, the ETS price went down as well: there was fear for a recession, projections were that the economy would slow down. However, despite an initial dip in the ETS price, the price went up (with the cautionary statement that this may have been partly canceled out by the massive economic stimuli).

This was the moment for CO2 action though: there was an incentive to start doing something about the CO2 emissions. However, very quickly, energy prices soared as well, which was exacerbated by the war in Ukraine. Just browsing the news, it is clear that the climate is even less a priority then before.

Today, energy is scarce. By cutting out Russian oil and gas, without a reduction in demand, there is only that much energy available, making energy prices soar. Moreover, for any CO2 removal technology you need renewable energy to make sure the process is on net removing CO2.

So we are in a moment, where it makes sense for the CO2 capture and removal industry to look at CO2 utilization strategies. And of course, it makes a lot of sense to switch as much of the fossil fuel infrastructure towards renewables — not just from a climate, or CO2 management point-of-view, but also out of energy security, raw material independence and geopolitical considerations.

Only looking at the CO2 price is too limited to explain incentives for carbon capture and removal, and a more holistic approach is needed. In particular, the oil price is a crucial parameter in understanding the business case. Massive amounts of cheap, low-carbon energy are needed to build the CCS and CDR infrastructure, and to run it in an effective and carbon-negative way.

This is an important consideration for policy makers and companies alike: to solve both the energy and the CO2 question with well-aligned incentives, and avoid counteracting them with well-meant but ill-reasoned subsidies. Finally, one can wonder if leaving this Herculean and decisive task solely to the “free” market will provide the desired results in time.

In any case: what a time to be alive, and be working in the CO2 industry!

This article is also published on the author's blog. Energy Voices is a democratic space presenting the thoughts and opinions of leading Energy & Sustainability writers, their opinions do not necessarily represent those of illuminem.

illuminem briefings

Biodiversity · Nature

John Leo Algo

Ethical Governance · Environmental Sustainability

Steven W. Pearce

Adaptation · Mitigation

The Washington Post

Biodiversity · Nature

Euractiv

Carbon Market · Public Governance

Carbon Herald

Carbon Removal · Corporate Governance