Climate tech is dead. Long live green tech!

· 9 min read

💡 This article is featured in The Definitive Reading List: illuminem’s Recommended Sustainability Classics

Lately, the “RIP Climate Tech” narrative has been gaining traction, with some suggesting a rebrand to something more market-friendly, like resilience tech. But wrangling over terminology distracts from the bigger picture—one of continued momentum—and only fuels anti-climate narratives.

Yes, 2024 brought challenges, and 2025 holds uncertainties—Trump’s return, shifting European policies, and economic pressures. But much of the negativity stems from misinterpreted policy shifts and out-of-context growth data, rather than a true decline.

In reality, green tech is still expanding. Key policies like the EU Green Deal remain intact, green financing remains strong, and deployment continues to scale. This article breaks down the data, challenges the misconceptions, and explains why optimism in green tech should be more alive than ever.

Much has been said about the challenges facing the wind sector and European EV market in 2024. While growth slowed compared to 2023’s record-breaking surge in these two sectors, overall green tech still had a strong year, and analysts predict the momentum will continue into 2025.

It’s true European EV sales were flat in 2024, yet BloombergNEF attributes this more to policy timing than demand. Automakers had already met their 2021–24 binding CO2 emissions targets, and with stricter rules kicking in for 2025, many held back new models and price cuts.

That’s set to change. With new policies rolling out in 2025, Western and Central Europe expect a 43% jump in EV sales, pushing market share beyond 20%—a major milestone in the shift to electrification.

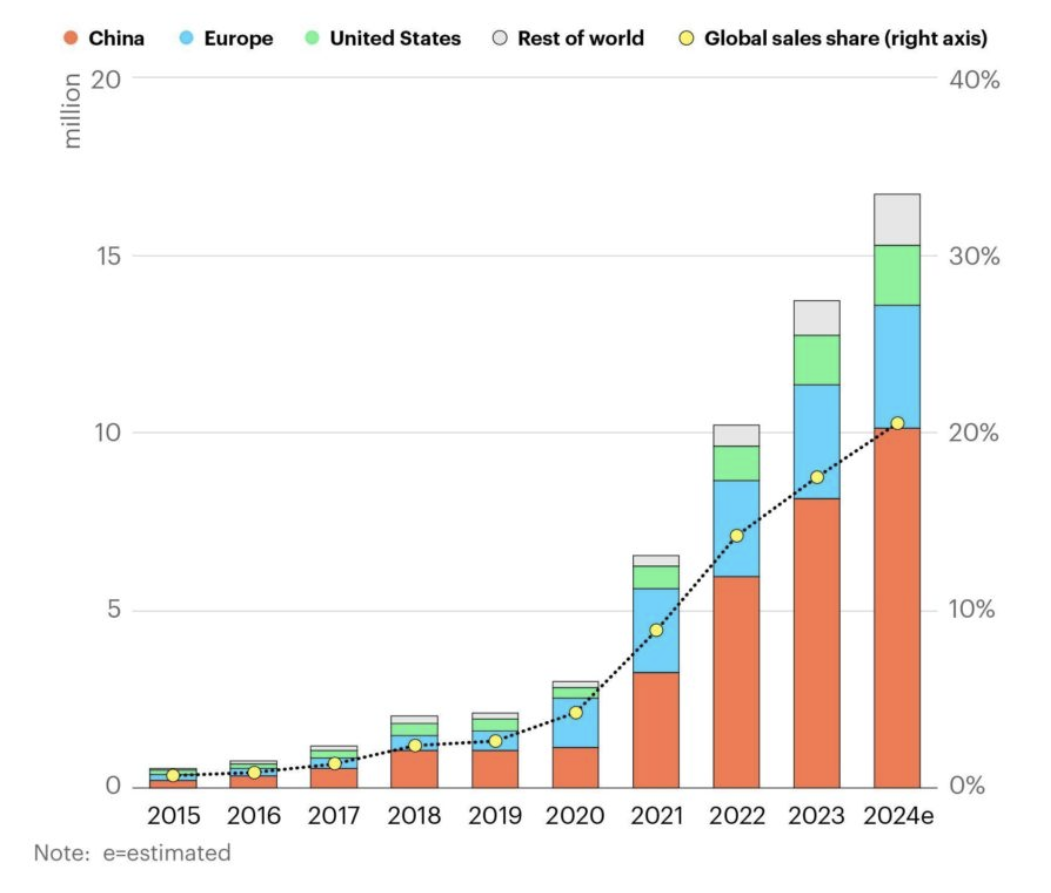

Globally, EV sales surged 25% in 2024, hitting a record-breaking 17 million units—nearly a quarter of all new car sales. Growth isn’t slowing down either, with global EV sales expected to rise another 30% in 2025, reaching 20 million vehicles.

Electric car sales by region and global sales share

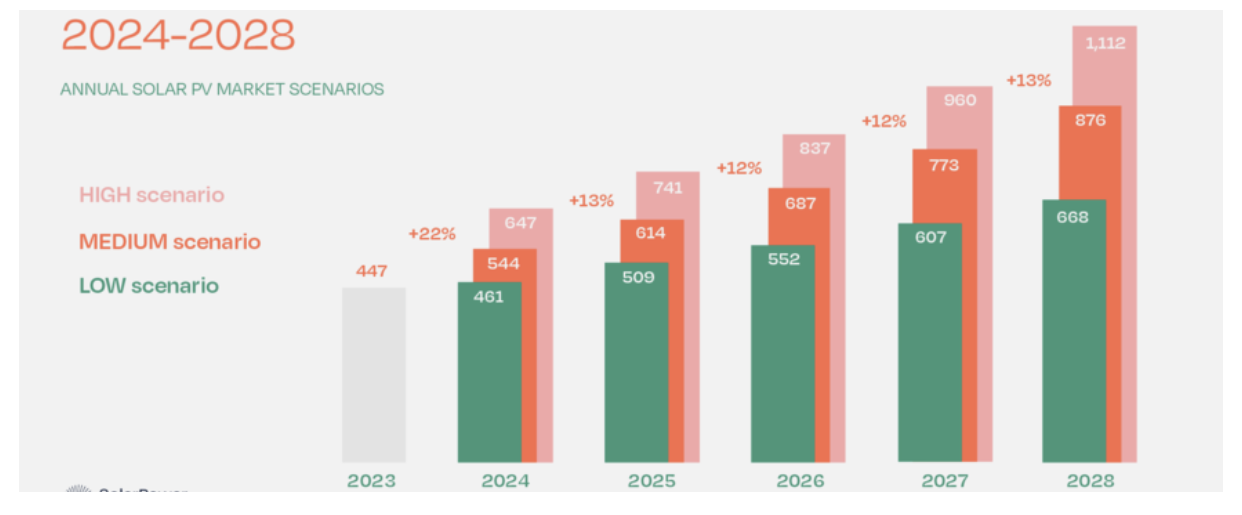

Global solar photovoltaic grew 29% more last year’s growth and beating analysts’ expectations—an impressive achievement given that 2023 was already unprecedented. China led the charge, shattering records with 277 GW of new solar capacity, blowing past its previous record of 217 GW in 2023 and on track to surpass 1 TW (1,000 GW) of total solar capacity by the end of 2026.

Meanwhile, the EU hit a major milestone: for the first time, solar overtook coal in the electricity mix, supplying 11% of Europe’s power in 2024, up from 9.3% in 2023. And the momentum isn’t slowing down. Europe is set to add 110 GW of new solar in 2025, more than doubling the market in just three years.

Global solar forecast 2024-2028

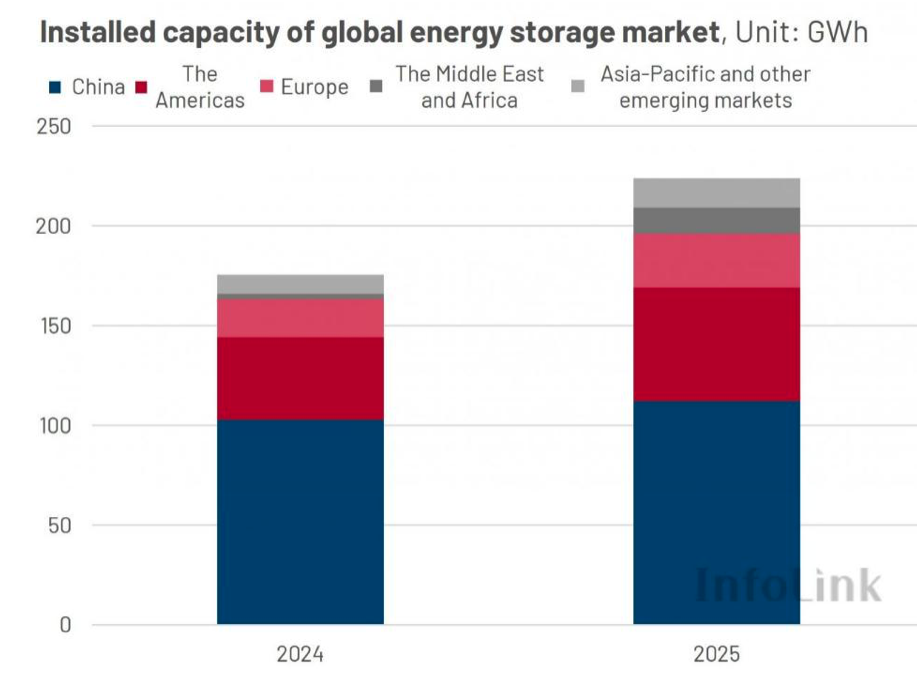

To complement the rapid expansion of renewables, energy storage is scaling up as well. In 2024, the global energy storage market added 175.4 GWh of new capacity, and the momentum is expected to continue. By 2025, new installed capacity is projected to reach 221.9 GWh, marking a 26.5% year-over-year increase.

Green tech deployment remains strong. Solar and EVs continue to scale rapidly, with policy timing—not lacking demand—playing a key role in short-term fluctuations.

The idea that renewables can’t survive without subsidies has gained traction, especially after high-profile bankruptcies in Europe following subsidy cuts and concerns about a potential IRA repeal in the U.S. But does this really reflect the industry’s long-term viability?

Renewables are inherently cheaper once infrastructure is in place, thanks to free energy inputs like sun and wind. While many green technologies currently rely on green premiums, these are temporary.

This momentum is clearest in more mature green tech sectors like EVs and renewables. Even under Trump-influenced forecasts, U.S. EV sales are still projected to triple by 2030, reaching one-third of new vehicle sales. Meanwhile, 900+ GW of new solar, wind, and storage capacity is projected to come online by 2035, even without tax credits.

During the premium-priced, scale-up phase, it’s not just governments driving demand—consumers and corporates are stepping in too. B2C companies face consumer pressure to adopt greener solutions, while B2B and industrial players often absorb higher costs when the path to price parity is clear. A prime example is recycled plastics, which have sustained a 60% premium over virgin plastic due to supply constraints, yet demand remains strong.

The economics of renewables remain fundamentally sound, and market forces—rather than subsidies—are increasingly driving growth.

The recent exits of major banks from the Net Zero Banking Alliance (NZBA) were symbolic and could weaken collective efforts, particularly in developing shared green finance methodologies. However, this doesn’t mean these banks are walking away from environmental commitments.

Their departures were largely legal risk-driven, fuelled by concerns over potential challenges from anti-environmental political figures like Trump, rather than a fundamental shift in strategy. Big players like JPMorgan, Citi, and BNP Paribas are still engaged, with BNP setting an ambitious target of 90% low-carbon energy in its financing for energy production by 2030—a major step forward.

Meanwhile, centralized banks are doubling down on green finance. The European Investment Bank (EIB) has already launched several €500 million counter-guarantee instruments as part of a €5 billion wind power package and is preparing another €500M fund to back green tech scale-ups. The European Investment Fund (EIF) also sees Energy and Environment as top investment areas and is expanding its guarantee and equity offerings to better support SMEs.

Some banks may be stepping back from collective frameworks, but the flow of capital into green finance remains strong—and in some cases, it’s accelerating.

Yes, tariffs have pushed up green tech costs in the U.S., and Europe is now facing similar challenges. But the bigger picture? Green tech prices are still falling faster than tariffs can slow them down.

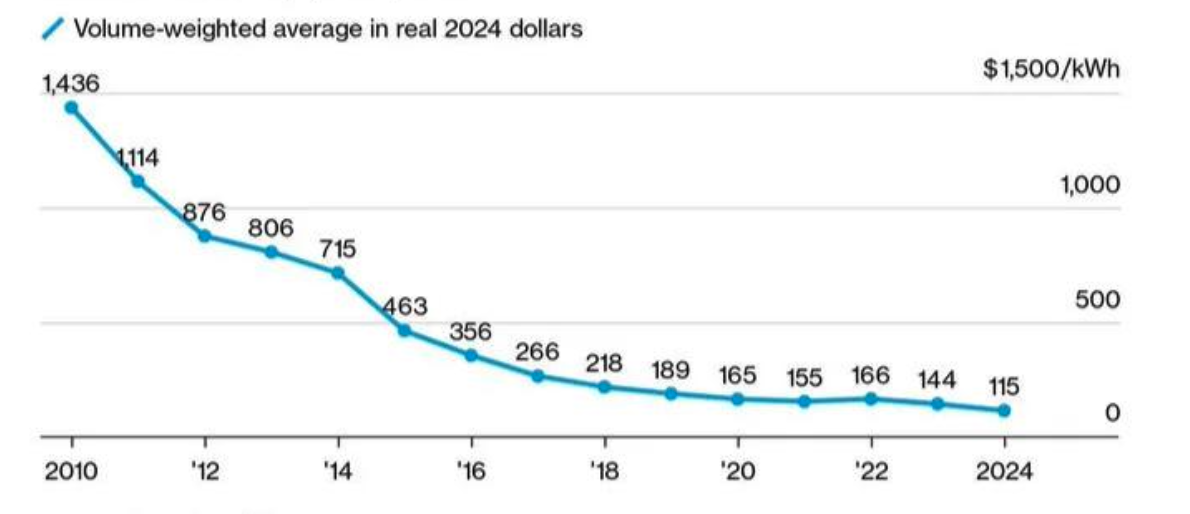

Battery prices have plummeted in the past decade—lithium-ion battery packs dropped 90% from 2010 to 2023 and fell another 20% in 2024, hitting $115/kWh for 2-hour systems. Goldman Sachs predicts $80/kWh by 2026, well below the $100/kWh price parity threshold with combustion engines.

Lithion-ion batter pack prices

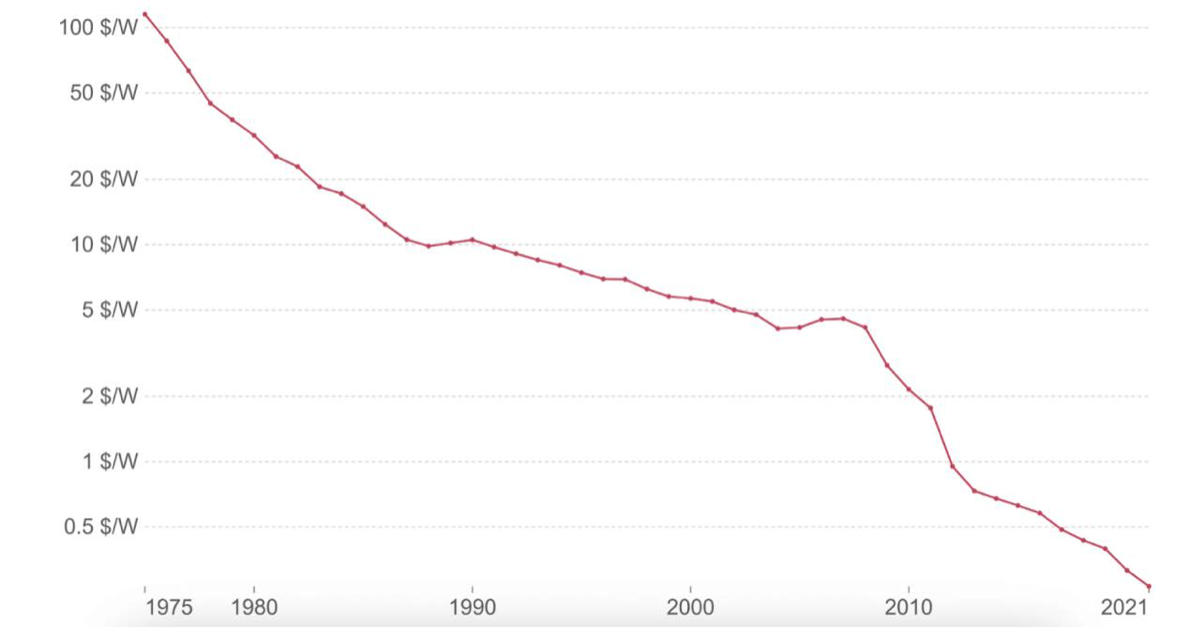

Solar module prices tell a similar story—as of January 2025, mainstream panels are selling for $0.12/W, a staggering 95% drop since 2010 when they were $2.15/W. While prices may not continue declining as sharply due to structural costs, massive R&D investments from China’s solar giants could change the game yet again.

With tens of billions flowing into solar innovation and promising advances in perovskite, tandem solar, and Space-Based Solar, we could be on the verge of another DeepSeek-style breakthrough—one that dramatically cuts costs and makes ultra-cheap green tech more accessible than ever.

Graph of solar panel price (1975-2021)

Market forces and innovation are driving affordability despite geopolitical hurdles.

Concerns are growing that the European Commission is framing regulations as a barrier to competitiveness.

Yet, so far, policy changes have mainly aimed at easing compliance for small businesses, particularly around CSRD and ESG reporting, rather than rolling back key environmental regulations.

Europe’s core environmental policies—including the ETS, RED, CBAM, and multi-billion-euro green funds—are deeply embedded in law, governance, and financial structures. These policies won’t be easily undone, and much of the previous EU Commission’s green agenda is only now starting to take effect, meaning there’s still positive momentum ahead.

Looking forward, the new EU Commission is reinforcing its environmental commitments, with plans to introduce a Clean Industrial Deal within its first 100 days, pushing toward the goal of making Europe the first climate-neutral continent by 2050. The UK is also following suit, launching its own CBAM and positioning itself as a renewable energy leader by 2030.

Shifting the narrative around green tech from purely an environmental issue to a key economic advantage is actually strengthening its position. The EU now frames its priorities around closing the innovation gap with the U.S. and China, strengthening supply chains, and securing raw materials and energy independence. This actually positions green tech closer to the heart of Europe’s industrial strategy, ensuring its political priority

Europe’s core environmental policies remain deeply embedded and difficult to fully reverse.

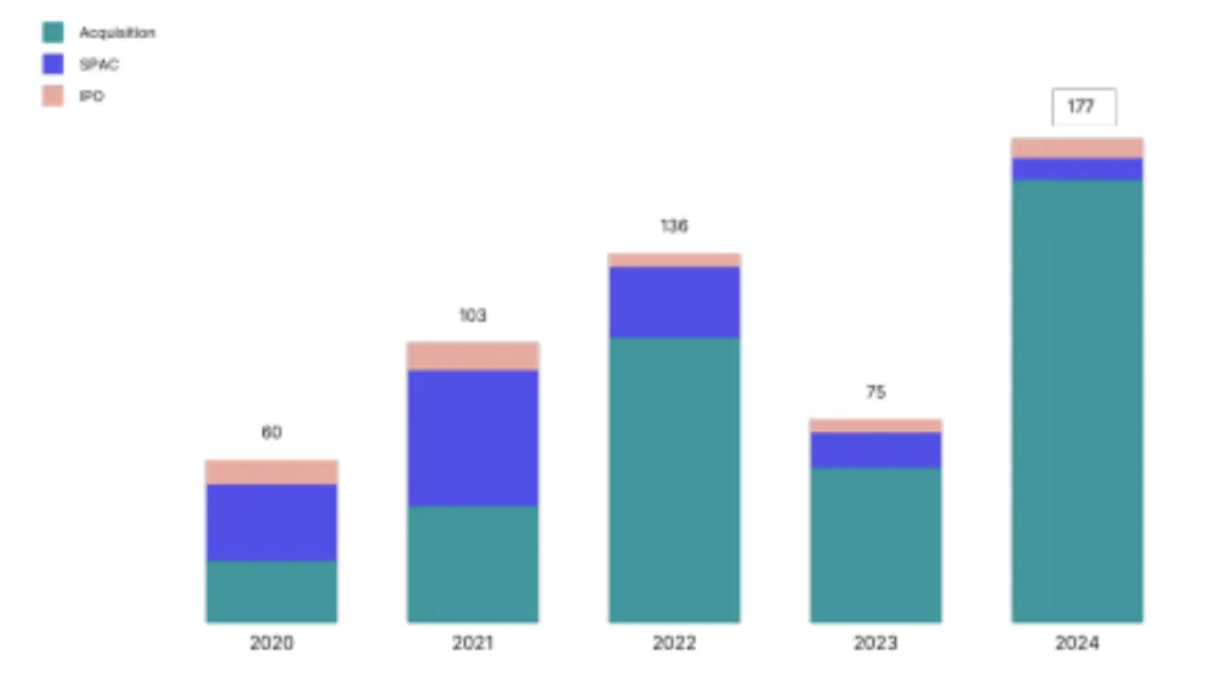

The space is still young, but corporate momentum is building. Exit activity last year hit 177 exits in 2024—a remarkable 136% increase from 2023. Most exits were acquisitions, yet IPOs ticked up slightly to six.

Green tech exits by type 2020-2024 (# of exits)

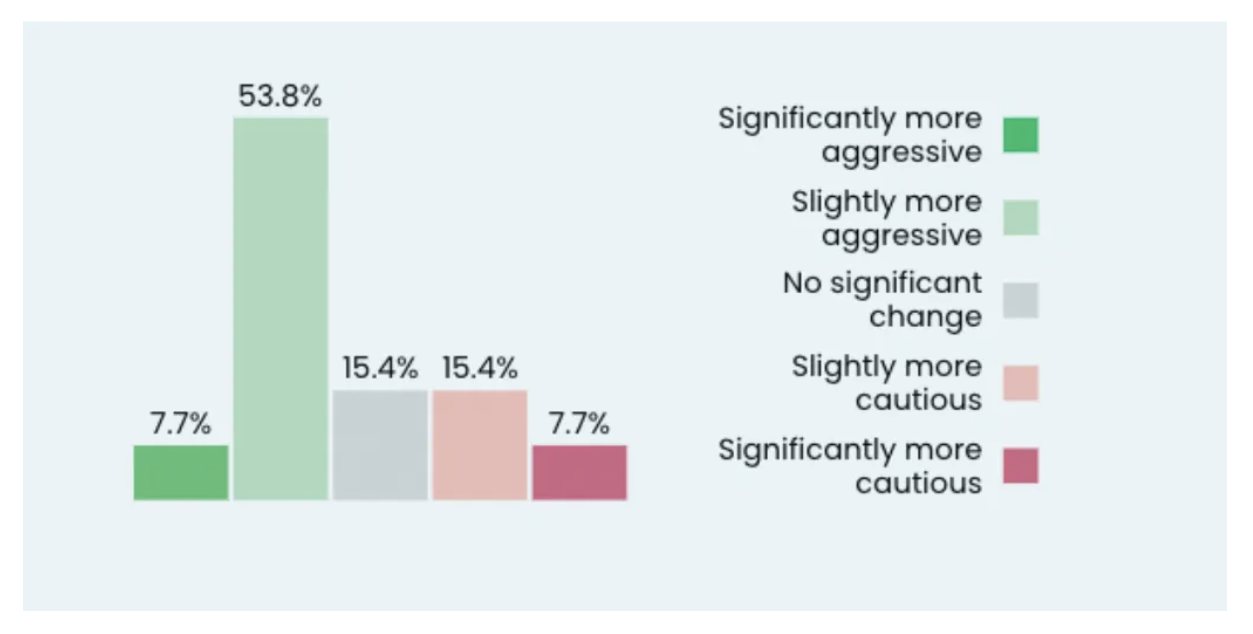

M&A activity is heating up, with 60% of corporates planning to ramp up acquisitions in 2025, according to a recent poll by NetZero Insights. Watch this space.

Corporate survey of M&A intentions for 2025

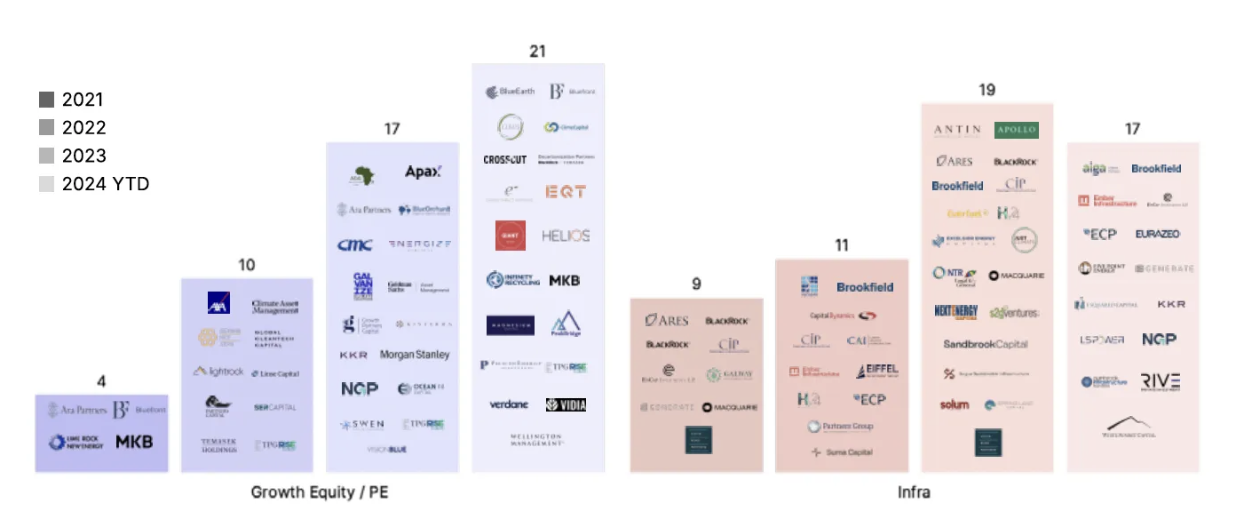

Meanwhile, green-focused dry powder remains strong, with $86 billion ready to deploy, increasingly shifting toward growth and infrastructure stages—a sign of market maturity. This ensures plenty of capital to support scaling and drive companies toward exit-ready stages.

New climate funds by type, 2021-2024 (# funds)

With strong corporate interest and billions in dry powder ready to deploy, the sector is well-positioned for continued growth and scaling.

The past year has been filled with headlines questioning the future of green tech, but when you dig into the data, it’s clear that momentum remains strong, and in many cases, is accelerating. Renewables are scaling faster than ever, EVs are becoming mainstream, environmental financing is holding steady, and corporate interest in exits is heating up. The policy landscape is shifting, but core environmental policies remain deeply embedded, and the economic case for green tech is stronger than ever.

More importantly, green tech is no longer just about the environment—it’s about economic growth, job creation, and national security. Governments worldwide, including the EU and UK, are positioning green tech as a strategic advantage, with investments in supply chain resilience, industrial innovation, and energy independence.

So while my favorite term is still “green tech” (let’s not forget water, waste, and biodiversity ), I really don’t mind what we call it. Even “Job-Creating-National-Security-Critical-Competitiveness-Tech” works—if it gets more people on board.

Whatever you call it, get excited, because this space is only just getting started.

illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

illuminem briefings

Geothermal · AI

illuminem briefings

Electric Vehicles · Green Tech

illuminem briefings

Electric Vehicles · Public Governance

Eco Business

Sustainable Finance · Public Governance

Carbon Herald

Carbon Removal · Corporate Governance

Responsible Investor

Sustainable Finance · ESG