A regional risk-sharing platform to develop the Southern African lithium sector

Unsplash

Unsplash Unsplash

Unsplash· 12 min read

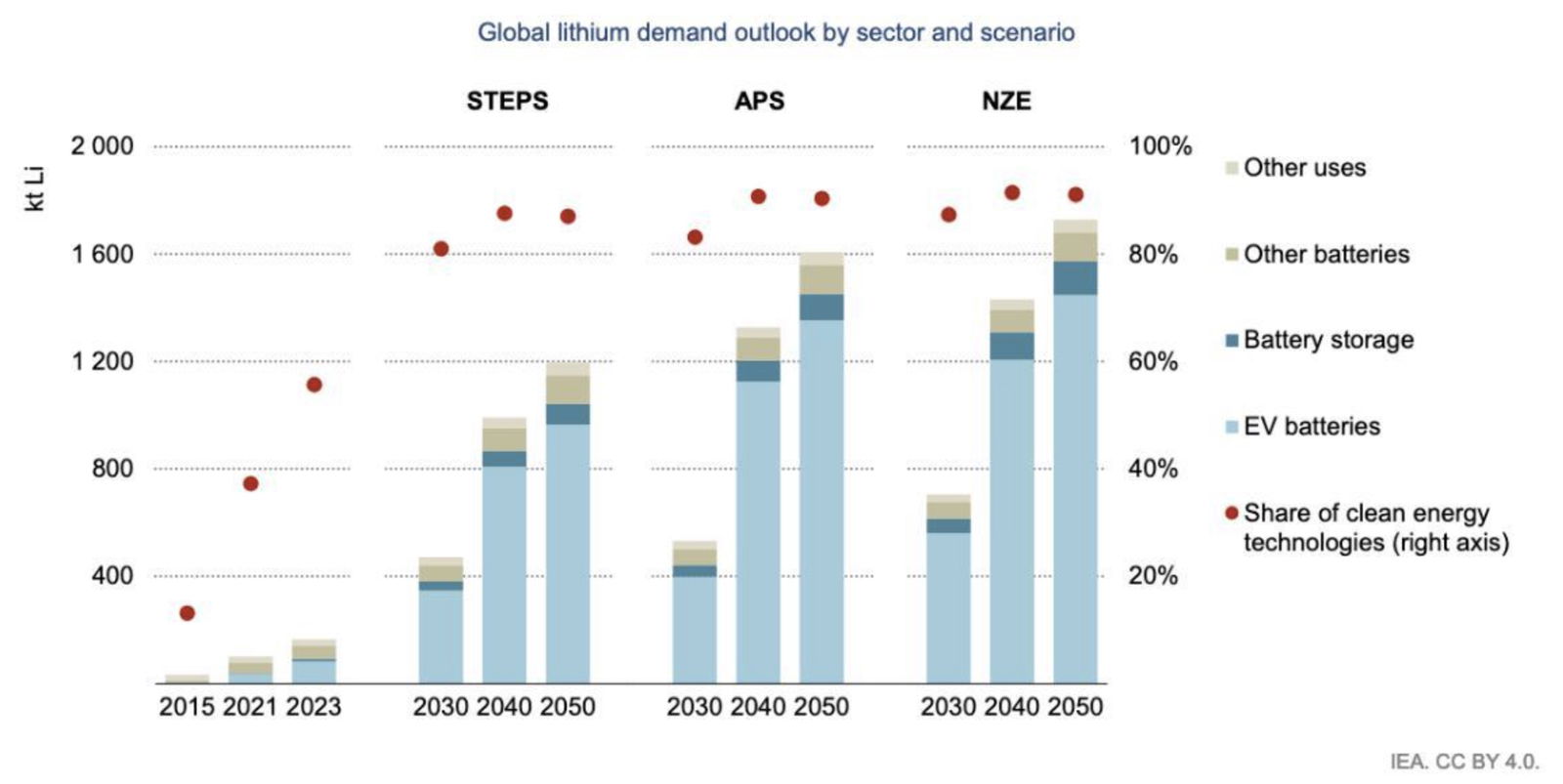

Lithium has recently gained traction in the global energy transition and the global race for critical minerals. It constitutes a fundamental part of the lithium-ion batteries employed in electric vehicles (EVs) as well as renewable energy storage systems, hence it is pivotal in both the global push for net zero emissions and the SDG 7. Following the accelerating EV industry in particular, the lithium demand is expected to outpace supply in the longer term—with a near threefold increase this decade according to the Stated Policies Scenario—potentially undermining the industry and the momentum of the clean energy transition.

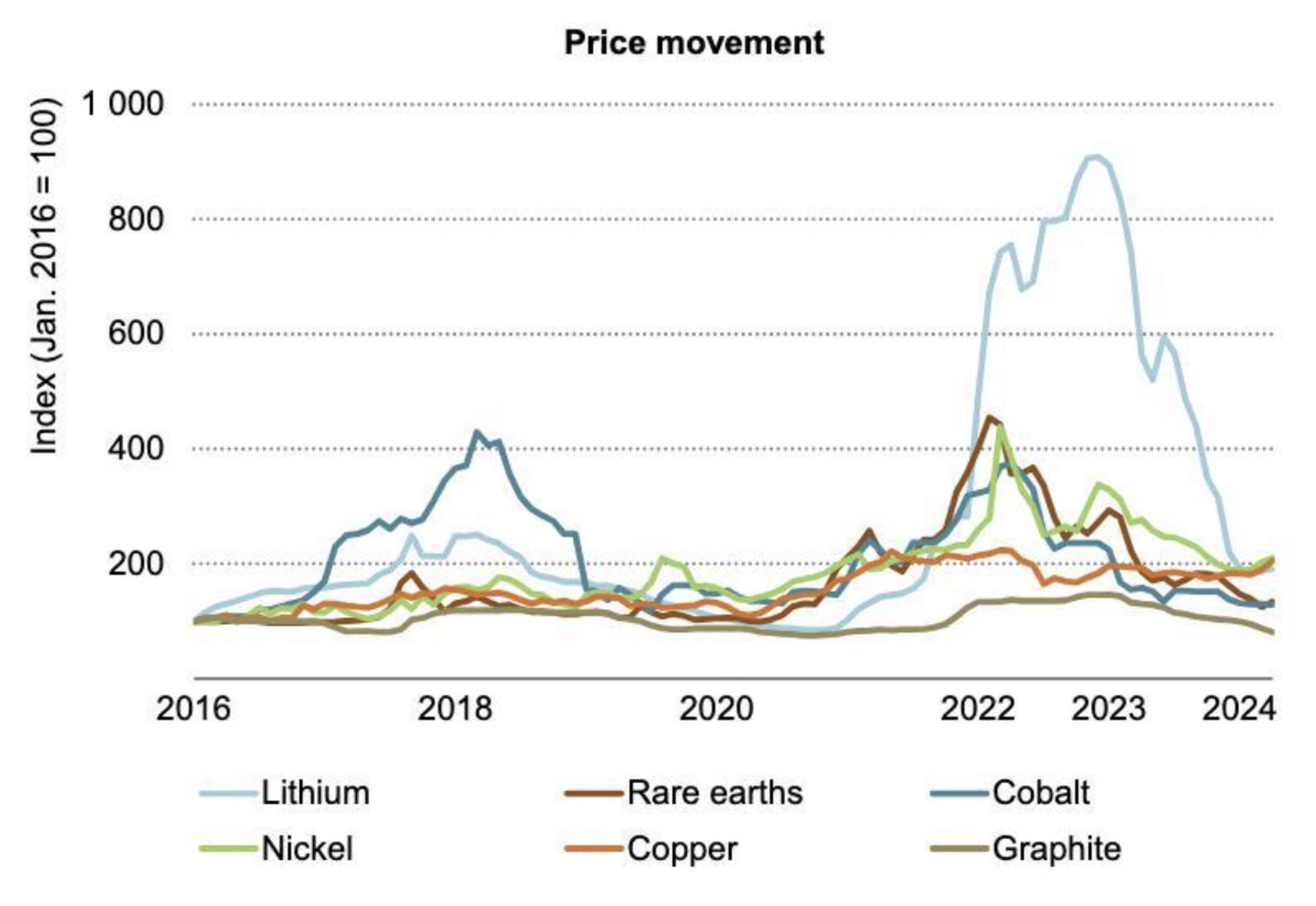

While the lithium sector has been concentrated in Australia, Chile and China, the Southern African region has increasingly gained attention for its largely untapped lithium reserves. The lithium deposits in countries such as Zimbabwe, Namibia and the Democratic Republic of Congo have framed the region as a leading prospect in the global lithium supply chain, which could support regional development while also meeting global energy needs. However, the region has not unlocked adequate (private) capital to develop the sector extensively—an investment gap spurred by extreme price volatility, weak regulation, and substantial non-commercial risks tied with commodity-dependent economies.

The transition from internal combustion engines to EVs combined with increasing demand on battery storage have together accelerated lithium-ion battery demand. According to the IEA’s global lithium demand outlook , global lithium demand is projected to reach 1200 kt Li by 2050 under the STEPS, 1600 kt Li under the APS, and 1700 kt Li under the NZE scenarios. These projections starkly contrast with the annual production of 190 kt Li in 2023.

Figure 1. Global lithium demand outlook by sector and scenario (IEA, 2024: 126)

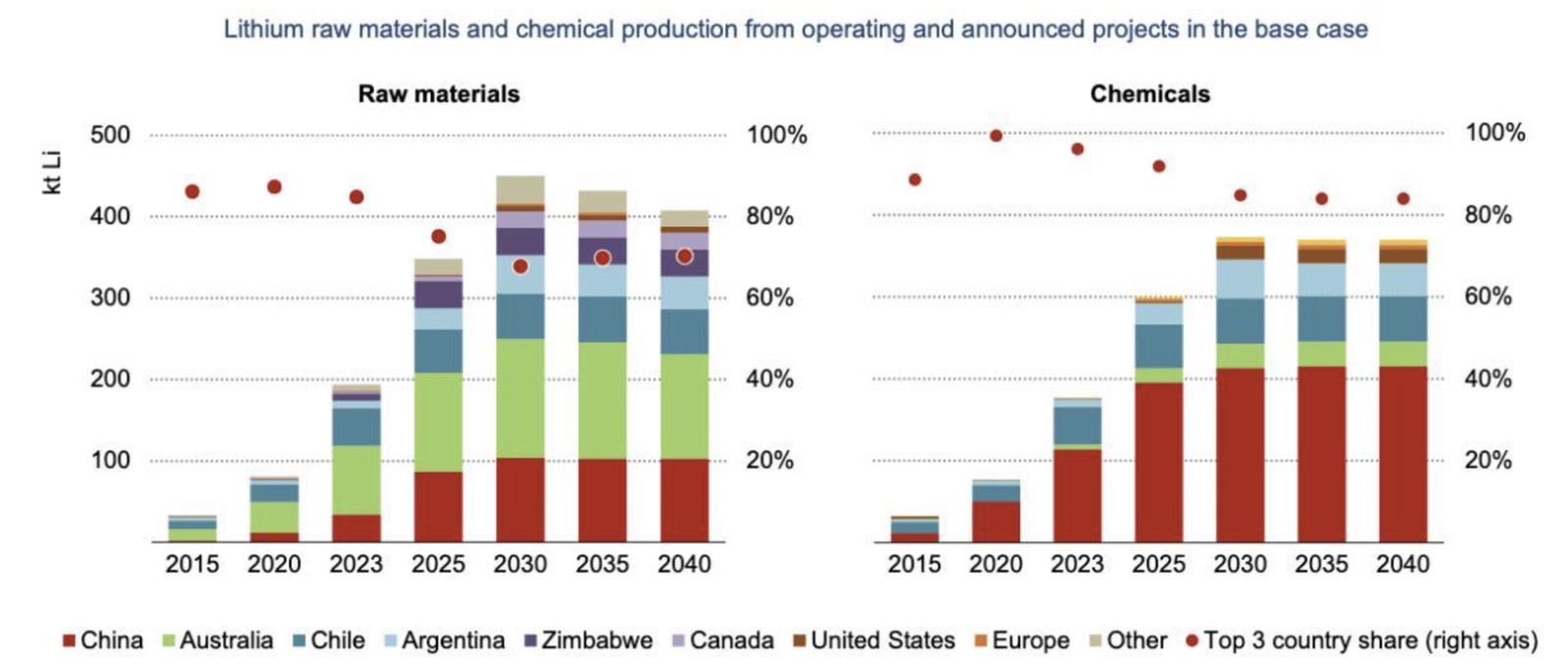

Meanwhile, lithium production has increased by more than 100% in the past three years, with Australia, Chile and China in the top. According to other predictions made by the IEA (2024), raw materials production could reach 450 kt Li in the base case and 520 kt Li in the high case by 2030—close to required levels in the STEPS and APS yet not NZE, however further investments are still needed. Moreover, Zimbabwe visibly emerges as a supplier, yet the present producers still dominate. Despite the illustrated increased production, the lithium sector is confronted by a complex supply-demand balance—the short-term supply is anticipated to meet demands yet it faces issues of limited diversification and high price volatility. The declining lithium prices have decreased production and deterred further investments, especially in emerging regions. Hence, IEA forecasts the need of 13 billion USD in investments in lithium mining by 2040 for simply the base case, where private capital plays a major role.

Figure 2. Lithium raw materials and chemical production from operating and announced projects in the base case (IEA, 2024: 126)

Southern Africa, with major lithium reserves in Zimbabwe, Namibia, and the DRC, is becoming a key player in global lithium supply. Output is expected to grow 24-fold from 2022 to 2027, with Zimbabwe leading production. However, most lithium is exported as raw ore, limiting economic benefits. Despite policies promoting local beneficiation, the sector faces challenges like volatile prices, limited transparency, and low value addition, which deter investment and increase dependence on China.

Figure 3. Comparative price movement of minerals 2016-2024 (IEA, 2024: 215)

Additionally, there are several non-commercial risks deterring private investments from the sector. Political instability, weak governance and corruption increase risk premiums, combined with its high regulatory unpredictability (e.g. Zimbabwe’s 2022 ban on raw lithium ore). These risks and low investment confidence are further aggravated by the affiliated socio-environmental challenges (e.g. artisanal mining) and inadequate infrastructure, together discouraging private investments.

The RRSP will in large function as a multifunctional regional platform with a centralised financial guarantee fund at its core, pooling resources from SADC, AfDB, international donors, and the private sector. The two main financial mechanisms are employed drawing upon the outlined objectives and specific context, together addressing commercial as well as non-commercial risks. They will be supported by the pooled guarantee fund. The RRSP will further be supported by ESG-connected stimulus as a supporting mechanism, in order to promote credibility amongst investors. Considering this specific risk-sharing framework, the RRSP can effectively promote financial resilience and stability in the sector in order to unlock further private investments and regional development. The RRSP acts as an innovative framework within the given Southern African lithium sector. While indeed risk-sharing platforms and multilateral guarantee funds are not novel per se, the RRSP is distinctive given its commodity- as well as lithium-specific value chains, address of commercial and non-commercial risks, as well regional and SADC-specific focus.

The minimum price floor guarantees to mitigate lithium price volatility by setting a baseline price, under which producers are compensated. The baseline is determined using a weighted moving average and profitability calculations. When market prices fall below the floor, the RRSP compensates producers; during high-price periods, producers contribute a percentage of revenues to the fund. This self-sustaining model reduces reliance on external financing, with reserves potentially invested in low-risk financial instruments like green bonds.

Minimum price floor guarantees are an effective mechanism for the RRSP, promoting revenue stability, reducing price volatility risks, and lowering capital costs. This mechanism boosts investor confidence, signals market stability, and reduces entry barriers, helping less resilient producers and fostering sector diversification. It also supports long-term sector development, encouraging investments throughout the value chain. Similar tools, like those in Côte d'Ivoire and Ghana's cocoa sectors, have successfully stabilized revenues and mitigated volatility, supporting their use in the RRSP.

PRGs will complement floor price guarantees by addressing non-commercial risks like political instability and regulatory changes. They compensate investors for losses due to actions like export bans, lowering perceived risks, financing costs, and unlocking private capital. Investors pay risk-adjusted fees to the RRSP fund, ensuring financial sustainability. PRGs will be linked to the same pooled fund as floor price guarantees, with coverage determined through a collaborative risk assessment. When disruptions occur, the fund will disburse compensation, boosting investor confidence.

The PRGs is an effective financial mechanism for the RRSP in Southern Africa’s lithium sector, as it can act as a safeguard against the existing non-commercial risks and hence unlock both domestic and foreign investors. Moreover, the ensuing improved investment environment can later on promote downstream activities, value addition and regional industrialisation. The effectiveness of PRGs can further be illustrated by previously successful initiatives, for instance the World Bank-backed PRG in the Nigerian 450 MW Azura-Edo Independent Power Project and AfDB’s PRG in the Kenyan Lake Turkana Wind Power Project. Followingly, the PRGs is an effective financial mechanism combined with minimum price floor guarantees to de-risk investments, promote financial resilience and unlock capital needed for long-term development.

ESG compliance will complement the RRSP’s financial mechanisms by linking support to sustainability criteria, aligning the lithium sector’s development with broader goals and boosting investor confidence. The SADC-AfDB partnership will establish ESG standards to access guarantees, promoting risk mitigation and resilience. Real-time monitoring, potentially through blockchain, will ensure compliance, increase transparency, and reduce greenwashing, further strengthening investor trust, as seen with De Beers’ Tracr platform.

This supporting mechanism will promote an alignment of the RRSP with regional and global goals as well as standards, for instance the SADC Industrialization Strategy and the Sustainable Development Goals. While this supports development goals, it also attracts further access to concessional financing by both private and institutional investors, who increasingly have a preference for ESG-adherent projects following e.g. increased consumer awareness. In sum, the ESG-connected supporting mechanism is effective within the RRSP framework in order to promote socio-environmental development in the sector and to unlock investments.

The governance framework of the RRSP constitutes a pivotal part in the stabilization of the regional lithium sector, strengthened value chain integration, and increased private investments. It hinges on a SADC-AfDB partnership which allows for local ownership combined with global best practices, paving the way for an effective regional development through inclusivity, transparency and accountability.

The SADC-AfDB partnership is central to the RRSP’s governance, fostering cross-border collaboration, regulatory adherence, and stable investment. SADC’s involvement strengthens regional regulations, tax policies, and standards, supporting the RRSP’s goals of value chain and socio-economic development. This partnership ensures local ownership, domestic value retention, and shared accountability, drawing on SADC's alignment with the RRSP's objectives and the effectiveness seen in the EAC's infrastructure projects

The AfDB enhances the RRSP through its financial expertise, credibility, and resource capacity. As Africa's largest development finance institution, it has extensive experience in de-risking investments, particularly in high-risk contexts, such as the Lake Turkana Wind Project. Its access to concessional funding and technical partnerships strengthens the RRSP, ensuring credibility and support for responsible lithium production in Southern Africa.

The RRSP will have a multi-level governance structure which enables an effective oversight of the financial mechanisms while promoting transparency, regional ownership and financial knowledge. It effectively operationalises the guarantees, promotes adoption to market changes, and progressively scales up operations within the platform phases. The Governing Board will be constituted of representatives from SADC member countries, the Afprivate investors, as well as civil society—essentially an inclusive board promoting the RRSP strategic objectives in parallel with regional and investor aspirations. Initially, it focuses on establishing the fund within RRSP and operationalising mechanisms. In turn, the Executive Secretariat will manage the operations such as fund disbursement and monitoring of ESG-practices under the governing board. The initial emphasis will be made on logistical efficiency, coordination with technical committees, and the blockchain-based system. The Specialized Committees enable an important oversight of main areas, capitalising on both local and international knowledge. Lastly, the Independent Audit Unit will assure transparency and accountability, to reduce risks and monitor the RRSP.

The RRSP financial structure is a critical part to the initiative, supporting a stabilised lithium sector in Southern Africa and regional industrialisation combined with domestic value retention. Accordingly, the structure enables a resilient financial model, through the RRSP’s pooled guarantee fund and stable revenue streams, in turn promoting financial sustainability.

A persistent theme in the RRSP financial structure is the pivotal role of blended finance—concessional funding from institutional actors mitigate the affiliated perceived risks by the private sector through its aforementioned mechanisms and hence unlock the needed private investment. Private capital, however, is integrated indirectly into the pooled fund, through risk-adjusted fees and revenue contributions brought by the guarantee mechanisms. Moreover, ESG compliance is a consistent theme throughout the structure and operational framework too—supporting the alignment between the financial mechanisms and ESG standards through the aforementioned benchmarks and blockchain-connected monitoring.

The RRSP’s pooled fund acts as the platform’s financial foundation, providing the needed liquidity to implement the financial mechanisms of minimum price floor guarantees and PRGs. The initial capitalization to the fund will stem from the SADC member states, the AfDB as well as international donors. These investments to the pooled fund ensures sufficient liquidity for early payouts as well as increased confidence-environments for the producers and investors. SADC member states will contribute by the required initial financial contributions promoting regional ownership, resilience and accountability. Moreover, the AfDB will also contribute financially to the RRSP’s pool fund together with its expertise and credibility, as delineated before, in parallel with concessional funds by international donors such as the EIB and the Green Climate Fund. These financial contributions will de-risk the RRSP and pave the way for the broader, long-term objectives.

The RRSP will be financially sustained in the long-term through a systematic revenue stream framework—the streams will refill the pooled fund whilst also ensuring sustainable viability and participatory incentives in the long-term. The streams will be supported by the financial mechanisms. The minimum floor price guarantee promotes individually-adjusted producer contributions to the fund during high-price periods of lithium, essentially constituting a self-sustaining and counter-cyclical design, even during periods of low market prices. Moreover, the PRG-inflicted risk-adjusted fees paid proportionally by investors according to project and risk profiles, the outlined self-enforcing cycle becomes strengthened which decreases external funding dependency. A part of the reserves will also be invested in low-risk financial instruments such as green bonds as well as later reinvested in activities throughout the value chain, to further support the revenue streams and the objectives.

A three-phased implementation of the RRSP supports a more sustainable, scalable, and contextually-suited initiative in line with regional aspirations and challenges—in summa promoting long-term socio-economic regional development and local value creation within the lithium sector.

The RRSP's initial phase focuses on setting up operational and financial frameworks to stabilize revenue and attract private investment. It includes establishing governance, transparency, ESG-compliance, and a pooled guarantee fund. The outcomes will be improved financial planning, reduced risk premiums, and a foundation for further investment, positioning Southern Africa as a key player in the sector.

In the second phase, the RRSP focuses on boosting domestic value addition in the lithium sector by extending guarantees to downstream activities like refining and processing. This supports regional industrialization, infrastructure development, and regulatory improvements. Expected outcomes include more jobs, reduced export dependence, and improved infrastructure from increased downstream investments.

In the third phase, the RRSP expands to include other critical minerals like cobalt and nickel, applying proven financial and ESG mechanisms. This phase aims to establish regional processing centers, foster innovation, and promote cross-border collaboration, enhancing value addition and integrating Southern Africa into global mineral supply chains. Streamlined regulations will create a stable investment environment, supporting economic diversification and industrialization.

The RRSP is crucial for stabilizing Southern Africa's lithium sector amid rising demand, offering a timely opportunity to boost domestic value addition and regional development. However, funding constraints pose a challenge, with significant upfront capital needed. The phased implementation strategy aims to spread funding needs over time, demonstrating early success to build confidence among donors and investors. Regional regulatory fragmentation and infrastructure gaps, such as transport corridors and energy access, hinder effective lithium value chain integration in Southern Africa. The RRSP seeks to standardize regulations through SADC’s industrialization strategy and co-finance infrastructure projects with revenue from high-price periods, creating a feedback loop that promotes regional cooperation and supports downstream activities.

The RRSP offers an innovative solution to Southern Africa’s lithium sector challenges, promoting regional development and sustainability. Through financial mechanisms like price floor and risk guarantees, along with ESG incentives, the RRSP stabilizes revenue, reduces risks, and attracts private investment. The SADC-AfDB partnership and phased approach support scalability, starting with revenue stabilization and progressing to value chain expansion. Despite challenges like financial constraints, regulatory fragmentation, and infrastructure gaps, the RRSP’s design includes strategies to address these issues while maintaining flexibility. Ultimately, the RRSP fosters regional industrialization and contributes to global decarbonization efforts.

illuminem Voices is a democratic space presenting the thoughts and opinions of leading Sustainability & Energy writers, their opinions do not necessarily represent those of illuminem.

illuminem briefings

Energy Sources · Lithium

illuminem briefings

Energy Sources · Lithium

Rob Karpati

Lithium · Copper

The Wall Street Journal

Lithium · Corporate Governance

Batteries News

Lithium · Battery

BBC

Lithium · Battery